What Is FICA Tax, Understanding Payroll Tax Requirements

Por um escritor misterioso

Last updated 25 fevereiro 2025

FICA tax refers to the taxes withheld by employers for Social Security and Medicare. Learn more about the FICA tax and how it’s calculated.

What are payroll deductions? Mandatory & voluntary, defined

FICA Tax in 2022-2023: What Small Businesses Need to Know

2019 Payroll Taxes Will Hit Higher Incomes

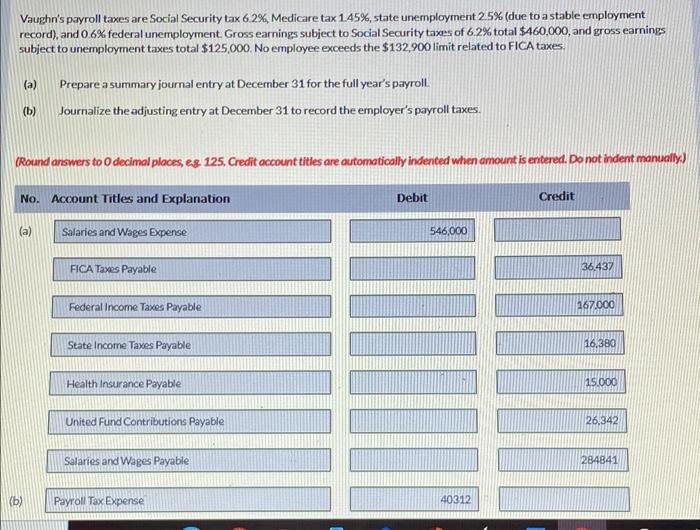

Solved Vaughn's payroll taxes are Social Security tax 6.2%

What Is the FICA Tax and Why Does It Exist? - TheStreet

What is Fica Tax?, What is Fica on My Paycheck

Payroll Tax Calculator for Employers

Federal & State Payroll Tax Rates for Employers

Federal Insurance Contributions Act - Wikipedia

The Ins and Outs of U.S. Payroll Requirements - What UK Businesses Need to Know

Recomendado para você

-

What is FICA Tax? - The TurboTax Blog25 fevereiro 2025

-

What is FICA25 fevereiro 2025

What is FICA25 fevereiro 2025 -

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg) Federal Insurance Contributions Act (FICA): What It Is, Who Pays25 fevereiro 2025

Federal Insurance Contributions Act (FICA): What It Is, Who Pays25 fevereiro 2025 -

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)25 fevereiro 2025

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)25 fevereiro 2025 -

:max_bytes(150000):strip_icc()/fica-taxes-and-calculator-on-a-table--874829160-42e252082fb1486dae0bc7cddbcaa16e.jpg) Why Is There a Cap on the FICA Tax?25 fevereiro 2025

Why Is There a Cap on the FICA Tax?25 fevereiro 2025 -

What is the FICA Tax? - 2023 - Robinhood25 fevereiro 2025

-

What is the FICA Tax Refund?25 fevereiro 2025

What is the FICA Tax Refund?25 fevereiro 2025 -

FICA Tax in 2022-2023: What Small Businesses Need to Know25 fevereiro 2025

FICA Tax in 2022-2023: What Small Businesses Need to Know25 fevereiro 2025 -

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student25 fevereiro 2025

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student25 fevereiro 2025 -

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons25 fevereiro 2025

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons25 fevereiro 2025

você pode gostar

-

Sono sempre io di Jojo Moyes: riassunto trama e recensione25 fevereiro 2025

Sono sempre io di Jojo Moyes: riassunto trama e recensione25 fevereiro 2025 -

Um Músico Do Pianista é De Execução E De Jogo Alguma Música Agradável Usando Um Teclado De Piano Em Uma Fase Em Algum Clube Notur Foto de Stock - Imagem de entretenimento25 fevereiro 2025

Um Músico Do Pianista é De Execução E De Jogo Alguma Música Agradável Usando Um Teclado De Piano Em Uma Fase Em Algum Clube Notur Foto de Stock - Imagem de entretenimento25 fevereiro 2025 -

X-এ Aiya: Overlord IV Ep 9 I was surprised the king apologized, but the answer is still the same and they would attack them in a month with the only exception if25 fevereiro 2025

-

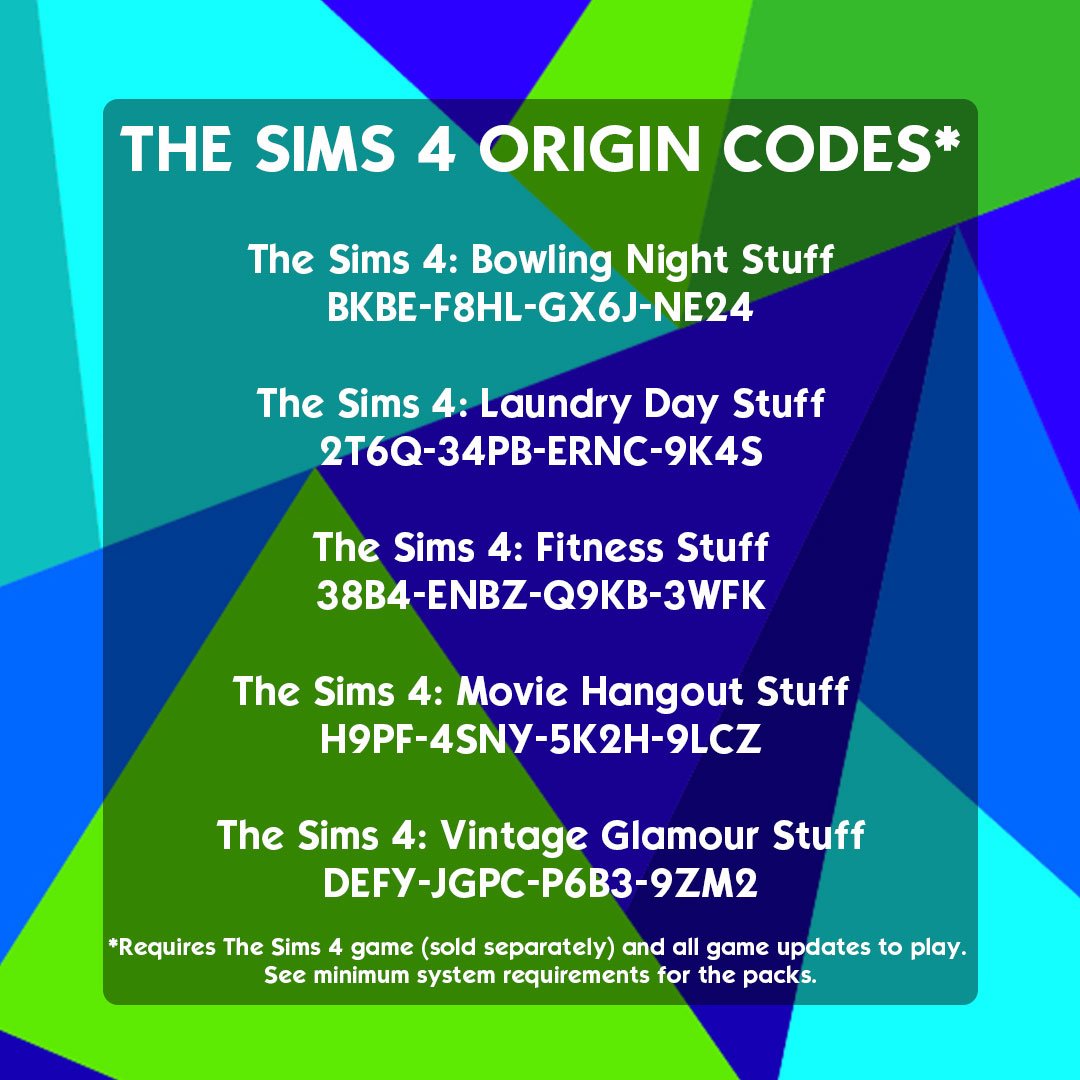

The Sims on X: Another round of birthday codes!🎁 The first to25 fevereiro 2025

The Sims on X: Another round of birthday codes!🎁 The first to25 fevereiro 2025 -

Super Mario Odyssey for Switch ᴴᴰ Full Playthrough (100% Walkthrough Part 1)25 fevereiro 2025

Super Mario Odyssey for Switch ᴴᴰ Full Playthrough (100% Walkthrough Part 1)25 fevereiro 2025 -

Qual Desenho Antigo Você Prefere?25 fevereiro 2025

Qual Desenho Antigo Você Prefere?25 fevereiro 2025 -

World War Z Difficulty Spike on Consoles Not Intended, Caused by Crossplay Integration - MP1st25 fevereiro 2025

World War Z Difficulty Spike on Consoles Not Intended, Caused by Crossplay Integration - MP1st25 fevereiro 2025 -

Gears of War 4 available worldwide on Xbox One and Windows 10 PC25 fevereiro 2025

Gears of War 4 available worldwide on Xbox One and Windows 10 PC25 fevereiro 2025 -

BVBooks Editora Evangélica - Todas as Bíblias - Bíblia Bilíngue25 fevereiro 2025

BVBooks Editora Evangélica - Todas as Bíblias - Bíblia Bilíngue25 fevereiro 2025 -

história real – Heleninha Drumond25 fevereiro 2025

história real – Heleninha Drumond25 fevereiro 2025