What is FICA Tax? - The TurboTax Blog

Por um escritor misterioso

Last updated 09 março 2025

Quick Answer: FICA is a payroll tax on earned income that covers a 6.2% Social Security tax and a 1.45% Medicare tax. If you’ve watched “Friends,” you can probably relate to Rachel opening her first paycheck and asking, “Who’s FICA? Why’s he getting all my money?” If you asked, you were probably told it was

Intuit TurboTax 2023 (Tax Year 2022) Review

What are self-employment taxes? - TurboTax Support Video

Overpaid Tax: Why It Matters to You - The TurboTax Blog

How to Fill Out a 1099 Form: Everything Business Owners Need to

What Are FICA Taxes? – Forbes Advisor

IRS Announces They Are Working on a New 1040 Tax Form: Intuit

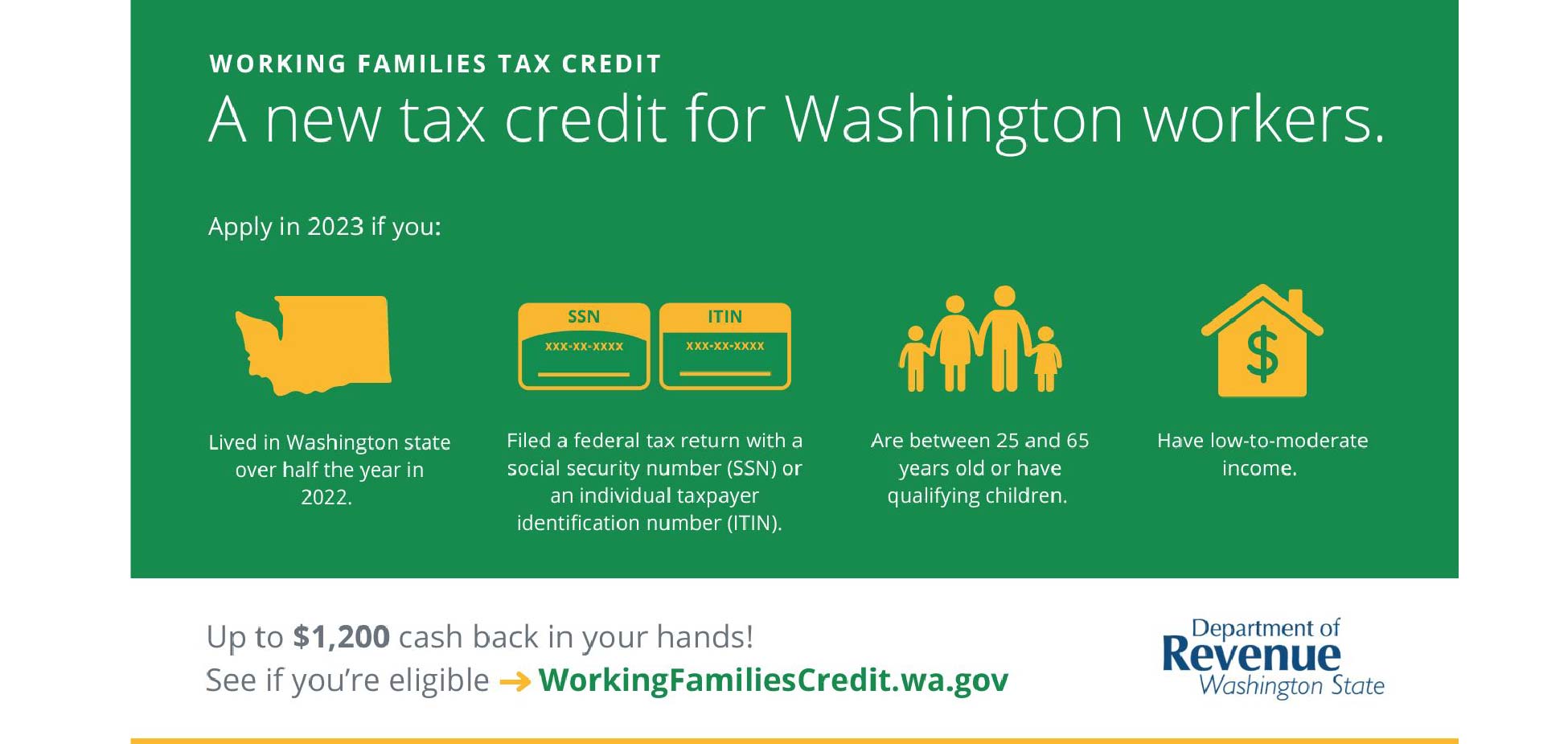

Blog posts by tag Verity Credit Union

How Holiday Bonuses are Taxed for Contract Workers - The TurboTax Blog

Save Money. Ace Tax Season. - Members First Credit Union

Are Social Security Benefits Taxable? - The TurboTax Blog

Bonus Time: How Bonuses Are Taxed and Treated by the IRS - The

Recomendado para você

-

What Is FICA Tax? A Complete Guide for Small Businesses09 março 2025

What Is FICA Tax? A Complete Guide for Small Businesses09 março 2025 -

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg) Federal Insurance Contributions Act (FICA): What It Is, Who Pays09 março 2025

Federal Insurance Contributions Act (FICA): What It Is, Who Pays09 março 2025 -

2023 FICA Tax Limits and Rates (How it Affects You)09 março 2025

2023 FICA Tax Limits and Rates (How it Affects You)09 março 2025 -

What is the FICA Tax and How Does it Connect to Social Security?09 março 2025

-

What Is FICA Tax?09 março 2025

What Is FICA Tax?09 março 2025 -

What it means: COVID-19 Deferral of Employee FICA Tax09 março 2025

What it means: COVID-19 Deferral of Employee FICA Tax09 março 2025 -

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine09 março 2025

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine09 março 2025 -

How to FICA Tax and Tax Withholding Work in 2021-2022 - Reconcile Books09 março 2025

How to FICA Tax and Tax Withholding Work in 2021-2022 - Reconcile Books09 março 2025 -

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons09 março 2025

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons09 março 2025 -

Students on an F1 Visa Don't Have to Pay FICA Taxes —09 março 2025

Students on an F1 Visa Don't Have to Pay FICA Taxes —09 março 2025

você pode gostar

-

100+ Moda Crianças Boneca Garotinha Batom De Maquiagem fotos de09 março 2025

100+ Moda Crianças Boneca Garotinha Batom De Maquiagem fotos de09 março 2025 -

Persona 5 Royal Steelbook Edition, SEGA, PlayStation 4, 73086522027409 março 2025

Persona 5 Royal Steelbook Edition, SEGA, PlayStation 4, 73086522027409 março 2025 -

How to Block Apps on Nintendo Switch09 março 2025

How to Block Apps on Nintendo Switch09 março 2025 -

Golf Business News - Revamped 2023 Ryder Cup venue hosts Italian Open09 março 2025

Golf Business News - Revamped 2023 Ryder Cup venue hosts Italian Open09 março 2025 -

PREMIUM GRATIS NO BROOKHAVEN RP 😱 (Roblox)09 março 2025

PREMIUM GRATIS NO BROOKHAVEN RP 😱 (Roblox)09 março 2025 -

ATIVIDADES DIVERSAS CLÁUDIA: Montar painel - Dia da Consciência Negra Desenhos de arte simples, Dia da consciência negra, Desenhos zentangle09 março 2025

ATIVIDADES DIVERSAS CLÁUDIA: Montar painel - Dia da Consciência Negra Desenhos de arte simples, Dia da consciência negra, Desenhos zentangle09 março 2025 -

Bentô Cake, o bolinho na marmita, cai no gosto dos bauruenses09 março 2025

Bentô Cake, o bolinho na marmita, cai no gosto dos bauruenses09 março 2025 -

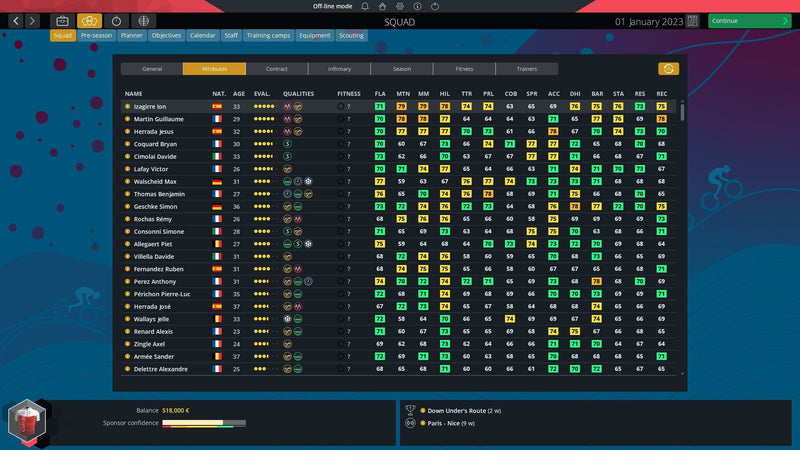

Pro Cycling Manager 2023 (PC) – igabiba09 março 2025

Pro Cycling Manager 2023 (PC) – igabiba09 março 2025 -

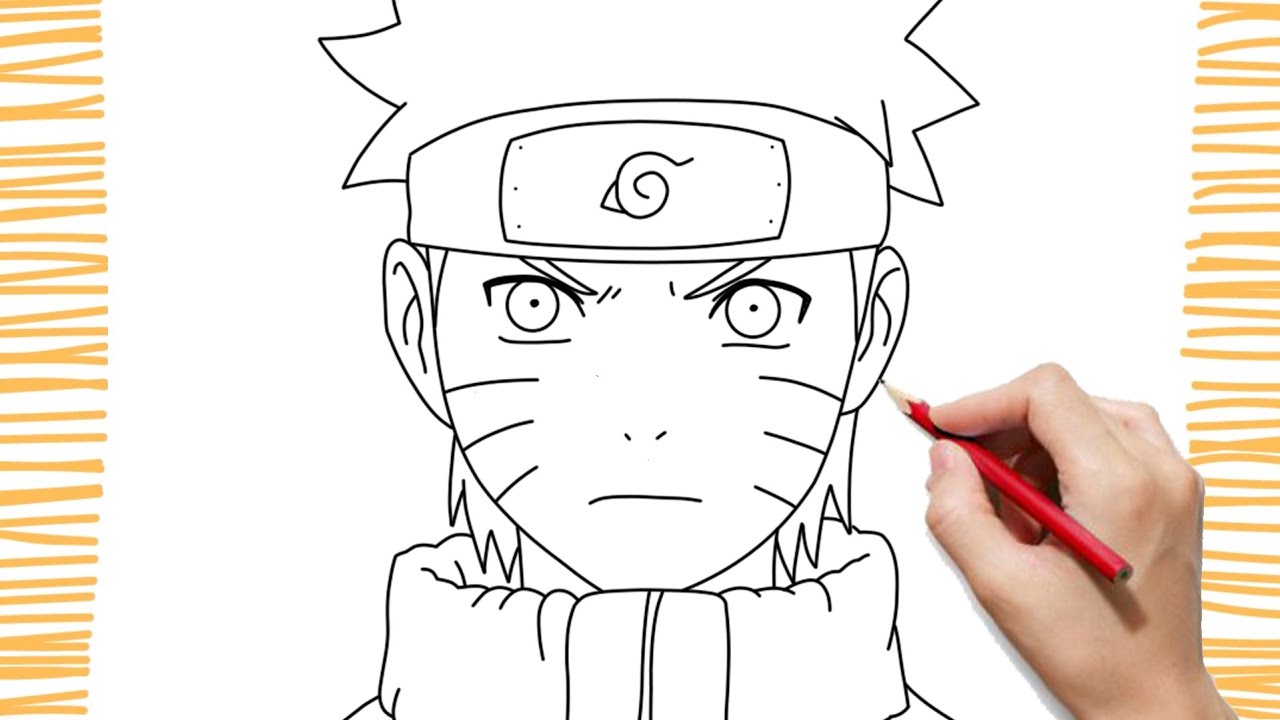

COMO DESENHAR O NARUTO CLÁSSICO ( PASSO A PASSO )09 março 2025

COMO DESENHAR O NARUTO CLÁSSICO ( PASSO A PASSO )09 março 2025 -

Miley Cyrus - Wrecking Ball (Afrojack Remix) Roblox ID - Roblox09 março 2025

Miley Cyrus - Wrecking Ball (Afrojack Remix) Roblox ID - Roblox09 março 2025