Refund of Unutilized ITC on Zero Rated Outward Supply of Exempted Goods

Por um escritor misterioso

Last updated 04 fevereiro 2025

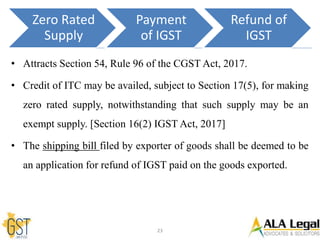

Refund of Unutilized Input Tax Credit (ITC) on Zero Rated Outward Supply of Exempted Goods As per Section 17(2) of CGST Act, 2017– ’Where the goods or services or both are used by the registered person partly for effecting taxable supplies including zero-rated supplies under this Act or under the IGST, and partly for effecting […]

Refund of Unutilised Input Tax Credit for Zero-Rated Supplies

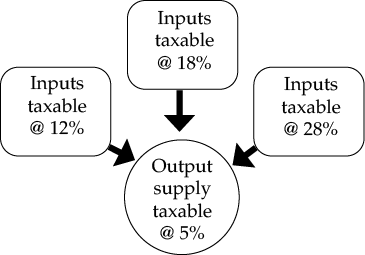

Input Tax Credit Refund - Inverted Tax Structure - IndiaFilings

Refund of Unutilised Input Tax Credit for Zero-Rated Supplies

Refund under Inverted Duty Structure « AIFTP

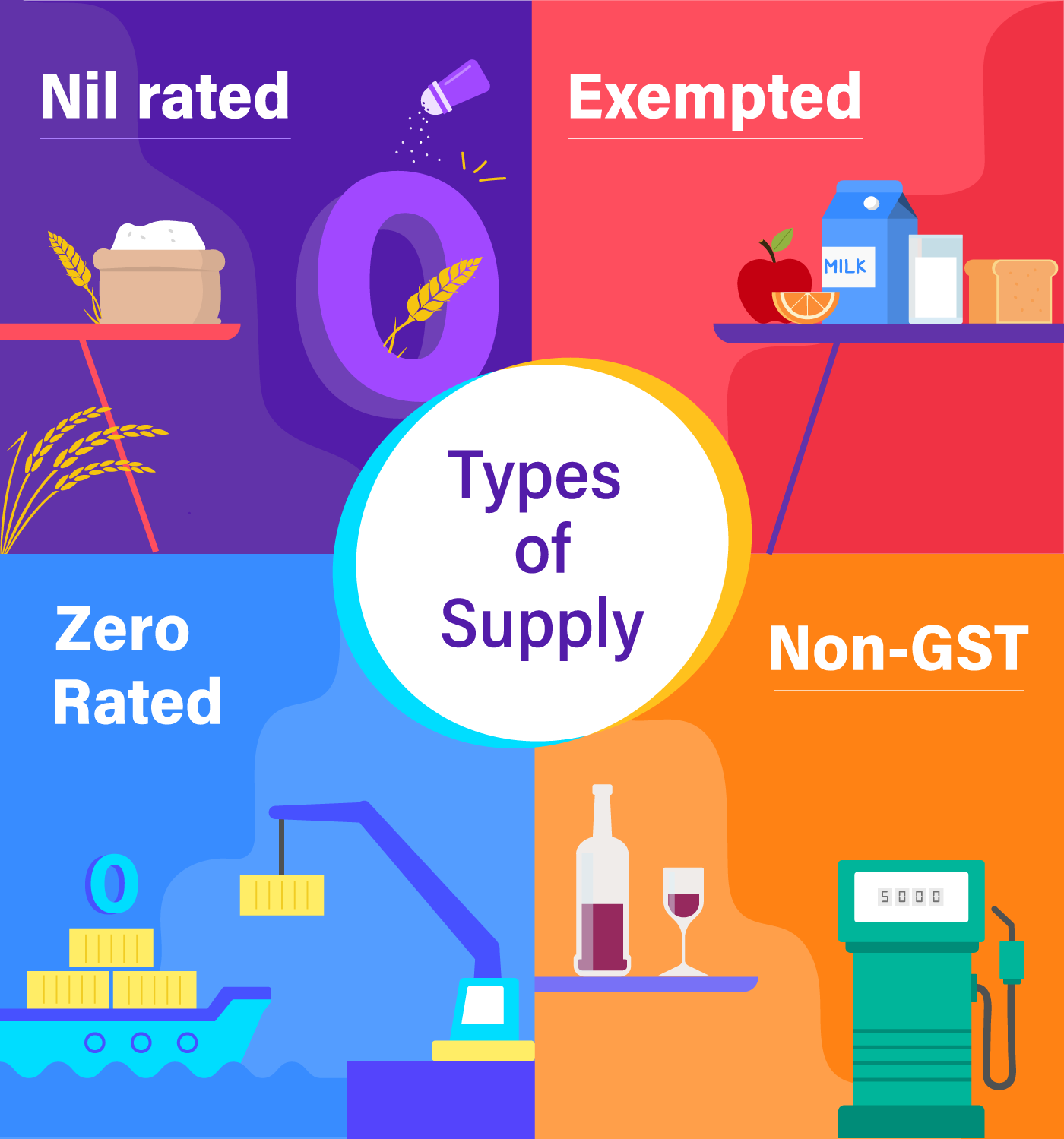

What is the difference between zero rated, nil rated, and exempted

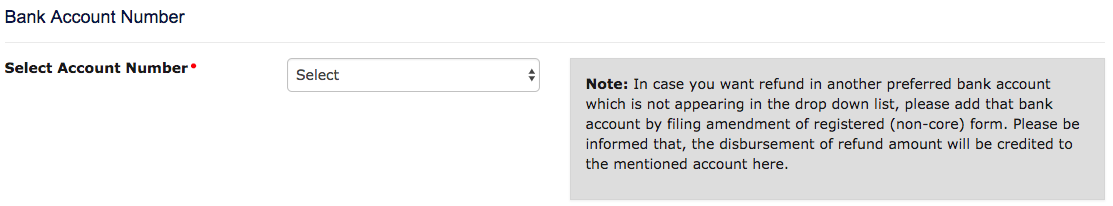

RFD-01 and Related Forms Guide

Understanding GST Input Tax Credit when Exempted/Taxable Supplies

Issues in Export & Import of Goods & Services vis-a-vis Foreign

Clarify certain refund related issues-Circular No. 147/03//2021

Recomendado para você

-

Difference between Nil Rated, Exempted, Zero Rate and Non-GST, FAQ04 fevereiro 2025

Difference between Nil Rated, Exempted, Zero Rate and Non-GST, FAQ04 fevereiro 2025 -

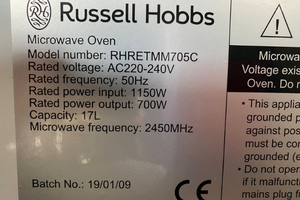

Inverters for Microwave Ovens - how to select the correct inverter04 fevereiro 2025

Inverters for Microwave Ovens - how to select the correct inverter04 fevereiro 2025 -

Split core current sensor HSTS023R Rated input ±50A ±100A ±200A ±300A – PowerUC04 fevereiro 2025

Split core current sensor HSTS023R Rated input ±50A ±100A ±200A ±300A – PowerUC04 fevereiro 2025 -

DIY Knowledge - Rated input, output04 fevereiro 2025

DIY Knowledge - Rated input, output04 fevereiro 2025 -

Angle Grinder Electrical Tools Rated Input Power (w) 2000W - China Angle Grinder, Electrical Tools04 fevereiro 2025

Angle Grinder Electrical Tools Rated Input Power (w) 2000W - China Angle Grinder, Electrical Tools04 fevereiro 2025 -

SN74LVCC3245A: The Absolute Max Ratings include the Input clamp current when going negative, but not in excess of the rail. Is this also 50mA or some lower number. - Logic forum04 fevereiro 2025

-

Energizer Power Packs - Products04 fevereiro 2025

Energizer Power Packs - Products04 fevereiro 2025 -

5500W 48VDC 100A MPPT hybrid inverter rated power 5500va Off Grid PV input: 120-500vdc 6000W w/o battery work - AliExpress04 fevereiro 2025

5500W 48VDC 100A MPPT hybrid inverter rated power 5500va Off Grid PV input: 120-500vdc 6000W w/o battery work - AliExpress04 fevereiro 2025 -

320.16W 24V 13.34A IP65 Rated Wide Input Constant Voltage LED Lighting Power Supply04 fevereiro 2025

320.16W 24V 13.34A IP65 Rated Wide Input Constant Voltage LED Lighting Power Supply04 fevereiro 2025 -

MVIKAS Welding Machine (ARC Series)-Rated Input Current:43.6A, Power:9.59KVA, No Load Voltage:58V04 fevereiro 2025

MVIKAS Welding Machine (ARC Series)-Rated Input Current:43.6A, Power:9.59KVA, No Load Voltage:58V04 fevereiro 2025

você pode gostar

-

Slither.io - Play Slither.io On Cookie Clicker 204 fevereiro 2025

Slither.io - Play Slither.io On Cookie Clicker 204 fevereiro 2025 -

RAINBOW FRIENDS Chapter 2: The Story So Far, GameToons Wiki04 fevereiro 2025

RAINBOW FRIENDS Chapter 2: The Story So Far, GameToons Wiki04 fevereiro 2025 -

Five, Bendu's Number Lore Official Wiki04 fevereiro 2025

Five, Bendu's Number Lore Official Wiki04 fevereiro 2025 -

Superbook - Kids Games04 fevereiro 2025

Superbook - Kids Games04 fevereiro 2025 -

Tier list(each class) update(S55) made by Yo卄ꏍ☁ : r/OPBR04 fevereiro 2025

Tier list(each class) update(S55) made by Yo卄ꏍ☁ : r/OPBR04 fevereiro 2025 -

Somali amv - Lily04 fevereiro 2025

Somali amv - Lily04 fevereiro 2025 -

Conjunto Vibrante De Peões De Jogo De Tabuleiro E Maquete De Cubo04 fevereiro 2025

Conjunto Vibrante De Peões De Jogo De Tabuleiro E Maquete De Cubo04 fevereiro 2025 -

One Piece logo - Roblox04 fevereiro 2025

-

Download Roblox Studio APK v4.4.0 for Android04 fevereiro 2025

Download Roblox Studio APK v4.4.0 for Android04 fevereiro 2025 -

Oshi no ko, Chapter 117 - Oshi no ko Manga Online04 fevereiro 2025

Oshi no ko, Chapter 117 - Oshi no ko Manga Online04 fevereiro 2025