Bona Fide Residence test explained for US expats - 1040 Abroad

Por um escritor misterioso

Last updated 24 fevereiro 2025

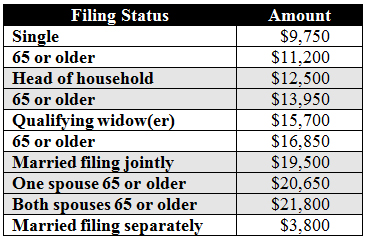

How can US expat qualify for the Foreign Earned Income exclusion? Passing Bona Fide Residence Test and meeting its requirements explained in tax infographic.

Bona Fide Residence Test - Remote Financial Planner

What to Know to Qualify Under the Bona Fide Residence Test

The Bona Fide Residence Test For Expats

Filing Form 2555 for the Foreign Earned Income Exclusion

foreign earned income « Tax-Expatriation

Income Tax Filing Guide for American Expats Abroad - Foreigners in Taiwan - 外國人在臺灣

Keyword:bona fide resident - FasterCapital

EXPAT TAX BASICS - Expat Tax Professionals

Foreign-Earned Income Exclusion for U.S. Citizens in China - China Briefing News

Recomendado para você

-

Chess in Education Commission - FIDE24 fevereiro 2025

-

Fidé Nashville TN24 fevereiro 2025

-

BONA FIDE, GOSHEN COFFEE24 fevereiro 2025

BONA FIDE, GOSHEN COFFEE24 fevereiro 2025 -

Sola Fide – 5 Solas of the Protestant Reformation by Christian Hilley on Dribbble24 fevereiro 2025

Sola Fide – 5 Solas of the Protestant Reformation by Christian Hilley on Dribbble24 fevereiro 2025 -

FIDE Online Arena (@FideOnlineArena) / X24 fevereiro 2025

FIDE Online Arena (@FideOnlineArena) / X24 fevereiro 2025 -

2023 FIDE General Assembly24 fevereiro 2025

2023 FIDE General Assembly24 fevereiro 2025 -

FIDE Aid Package to Open Tournaments 202324 fevereiro 2025

FIDE Aid Package to Open Tournaments 202324 fevereiro 2025 -

Magnus Carlsen clinches FIDE World Chess Cup 2023 – European Chess24 fevereiro 2025

Magnus Carlsen clinches FIDE World Chess Cup 2023 – European Chess24 fevereiro 2025 -

FIDE still considers Magnus Carlsen qualified and participating in24 fevereiro 2025

FIDE still considers Magnus Carlsen qualified and participating in24 fevereiro 2025 -

DGT Official FIDE set Weighted24 fevereiro 2025

DGT Official FIDE set Weighted24 fevereiro 2025

você pode gostar

-

Gege's illustration for JJK S2 Ep 18 & 19 : r/JuJutsuKaisen24 fevereiro 2025

Gege's illustration for JJK S2 Ep 18 & 19 : r/JuJutsuKaisen24 fevereiro 2025 -

Sesame Street play with me imagine with me DVD tested SHELF00i24 fevereiro 2025

Sesame Street play with me imagine with me DVD tested SHELF00i24 fevereiro 2025 -

Stream Don't Play With Me (Prod. by Loco Beats) by CAM24 fevereiro 2025

Stream Don't Play With Me (Prod. by Loco Beats) by CAM24 fevereiro 2025 -

Budds Beach the hidden gem in the heart of Surfers Paradise24 fevereiro 2025

Budds Beach the hidden gem in the heart of Surfers Paradise24 fevereiro 2025 -

Anime Festival Apk Download for Android- Latest version 1.0- com.tigerappcreator.cms.app56fdb602557dc24 fevereiro 2025

Anime Festival Apk Download for Android- Latest version 1.0- com.tigerappcreator.cms.app56fdb602557dc24 fevereiro 2025 -

Jetix Anuncia Dinossauro Rei24 fevereiro 2025

Jetix Anuncia Dinossauro Rei24 fevereiro 2025 -

![Top 10] Best Pokemon Games for PC That Are Amazing](https://www.gamersdecide.com/sites/default/files/authors/u160216/image8.jpg) Top 10] Best Pokemon Games for PC That Are Amazing24 fevereiro 2025

Top 10] Best Pokemon Games for PC That Are Amazing24 fevereiro 2025 -

AP Source: Gordon Hayward Headed to the Hornets24 fevereiro 2025

-

FREE TO PLAY TO EARN Games Live Right Now!24 fevereiro 2025

FREE TO PLAY TO EARN Games Live Right Now!24 fevereiro 2025 -

ATIVIDADE - ARTES AFRICANAS - TUDO SALA DE AULA.pdf - Google Drive24 fevereiro 2025

ATIVIDADE - ARTES AFRICANAS - TUDO SALA DE AULA.pdf - Google Drive24 fevereiro 2025