How derivative traders can make the most of increased volatility

Por um escritor misterioso

Last updated 30 janeiro 2025

It has become routine for Nifty to go up or down by 300 points —around 1,000 points on the Sensex—daily. Though heightened volatility unnerves normal investors, it spells opportunities for derivative traders.

Volatility Modeling and Trading: Q&A with Euan Sinclair

Currency Volatility: What is it & How to Trade It?

Wall Street Dealers in Hedging Frenzy Get Blamed for Volatility

Risks, Free Full-Text

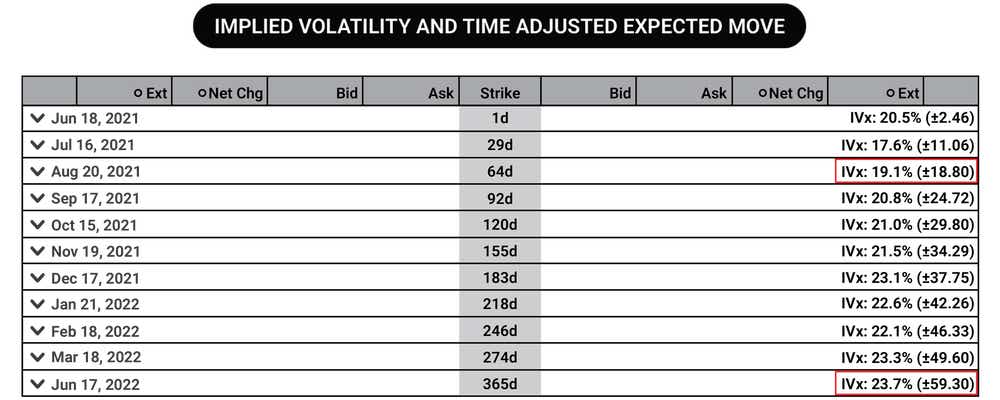

Implied Volatility (IV) In Options Trading Explained

:max_bytes(150000):strip_icc()/dotdash_Final_Trading_Volatile_Stocks_With_Technical_Indicators_Nov_2020-02-2b2f422acb804825bac05f317099fdaf.jpg)

Trading Volatile Stocks With Technical Indicators

Crypto Spot Market Activity Falls to 4.5-Year Low of $475B in August

Gross exposure in trading: Strategies for Managing Volatility

Big traders flock to US equity options with fleeting lifespans

Best Leveraged ETFs: A High-Risk, High-Reward Bet On Short-Term

Derivatives: Understanding the Role of Derivatives in the Futures

Recomendado para você

-

More 660 Unnerve Synonyms. Similar words for Unnerve.30 janeiro 2025

More 660 Unnerve Synonyms. Similar words for Unnerve.30 janeiro 2025 -

ECAC Vocabulary (week 2/6/12) Abstemious Enervate Fatuous Kowtow30 janeiro 2025

ECAC Vocabulary (week 2/6/12) Abstemious Enervate Fatuous Kowtow30 janeiro 2025 -

algo: Sebi paper on algo trading unnerves brokers. A protective30 janeiro 2025

algo: Sebi paper on algo trading unnerves brokers. A protective30 janeiro 2025 -

A Dubious Old Master Unnerves the Art World - The New York Times30 janeiro 2025

A Dubious Old Master Unnerves the Art World - The New York Times30 janeiro 2025 -

Big Brother, Crowd Control, and Pokémon Go30 janeiro 2025

-

GST unnerves big taxpayers of country's first Large Taxpayer Unit30 janeiro 2025

GST unnerves big taxpayers of country's first Large Taxpayer Unit30 janeiro 2025 -

Think You Have Good Ears? This Video May Unnerve You30 janeiro 2025

Think You Have Good Ears? This Video May Unnerve You30 janeiro 2025 -

Growing garbage mound unnerves Domlur residents30 janeiro 2025

Growing garbage mound unnerves Domlur residents30 janeiro 2025 -

Gov. Cox's use of pronouns unnerves Fox News' Tucker Carlson30 janeiro 2025

Gov. Cox's use of pronouns unnerves Fox News' Tucker Carlson30 janeiro 2025 -

Men Of All Ages Share How They Define Emotional Infidelity30 janeiro 2025

Men Of All Ages Share How They Define Emotional Infidelity30 janeiro 2025

você pode gostar

-

A Guide to Teaching Writing During Distance Learning With30 janeiro 2025

A Guide to Teaching Writing During Distance Learning With30 janeiro 2025 -

Mahou Shoujo ni Akogarete - Araga Kiwi - Hiiragi Utena - Morino Korisu - Clear File (Melonbooks, Takeshobo)30 janeiro 2025

Mahou Shoujo ni Akogarete - Araga Kiwi - Hiiragi Utena - Morino Korisu - Clear File (Melonbooks, Takeshobo)30 janeiro 2025 -

Sistema De Códigos Do Dia 25/04/2023!!! Honkai: Star Rail30 janeiro 2025

Sistema De Códigos Do Dia 25/04/2023!!! Honkai: Star Rail30 janeiro 2025 -

Ping Pong & Drama', quadrinho nacional, ganha vídeo em estilo animê30 janeiro 2025

Ping Pong & Drama', quadrinho nacional, ganha vídeo em estilo animê30 janeiro 2025 -

Conheça os melhores games inspirados em caminhões30 janeiro 2025

Conheça os melhores games inspirados em caminhões30 janeiro 2025 -

Brinquedo Cks Carro Controle Remoto Animal Car AC-01 - Martinello30 janeiro 2025

Brinquedo Cks Carro Controle Remoto Animal Car AC-01 - Martinello30 janeiro 2025 -

The Last Of Us Part 1: 10 Best Interactions Between Joel & Ellie30 janeiro 2025

The Last Of Us Part 1: 10 Best Interactions Between Joel & Ellie30 janeiro 2025 -

Friends': Reunion Special Set To Tape Next Week – Deadline30 janeiro 2025

Friends': Reunion Special Set To Tape Next Week – Deadline30 janeiro 2025 -

Hoje é dia de Brasil na Copa do Mundo! Confira os horário da AME30 janeiro 2025

Hoje é dia de Brasil na Copa do Mundo! Confira os horário da AME30 janeiro 2025 -

Dragon Ball Super Manga30 janeiro 2025

Dragon Ball Super Manga30 janeiro 2025