Understanding FICA Taxes and Wage Base Limit

Por um escritor misterioso

Last updated 16 janeiro 2025

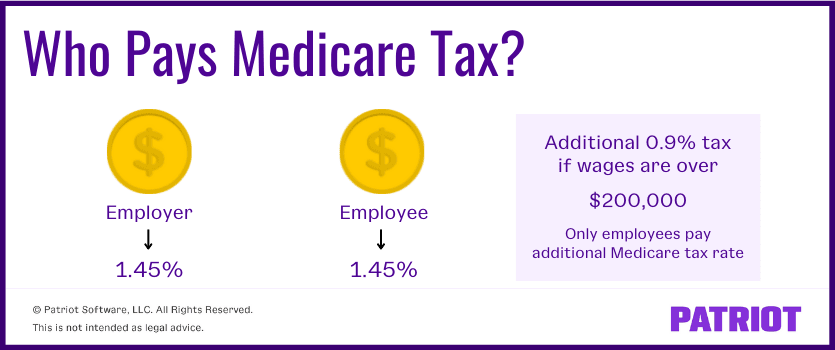

Employers deduct a certain amount from employee paychecks to pay federal income tax, Social Security tax, Medicare (Hospital Insurance) tax, and state income

Income Limit For Maximum Social Security Tax 2023 - Financial Samurai

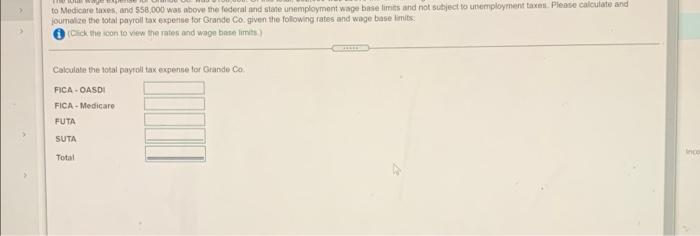

Solved The total wage expense for Grande Co. was $156,000.

Understanding pre vs. post-tax benefits

Wage Base Limit - FasterCapital

Learn About FICA Tax and How To Calculate It

Learn About FICA Tax and How To Calculate It

FICA explained: Social Security and Medicare tax rates to know in 2023

What are Employer Taxes and Employee Taxes?

Form W-2 Explained

:max_bytes(150000):strip_icc()/payroll-4191484-3x2-final-1-008077377d4a4d36bec1424f414b0d9d.png)

What Is Payroll, With Step-by-Step Calculation of Payroll Taxes

What is payroll tax?

Understanding solo 401(k) after-tax / total additions limit for

What is Self-Employment Tax? (2022-23 Rates and Calculator)

Recomendado para você

-

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes16 janeiro 2025

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes16 janeiro 2025 -

FICA Tax: 4 Steps to Calculating FICA Tax in 202316 janeiro 2025

FICA Tax: 4 Steps to Calculating FICA Tax in 202316 janeiro 2025 -

FICA Tax Exemption for Nonresident Aliens Explained16 janeiro 2025

FICA Tax Exemption for Nonresident Aliens Explained16 janeiro 2025 -

What Is FICA on a Paycheck? FICA Tax Explained - Chime16 janeiro 2025

What Is FICA on a Paycheck? FICA Tax Explained - Chime16 janeiro 2025 -

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax16 janeiro 2025

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax16 janeiro 2025 -

What is FICA tax? Are you struggling to understand what the FICA tax is and if you need to pay it as a small business owner? Check out this video, and16 janeiro 2025

-

What Are FICA Taxes And Why Do They Matter? - Quikaid16 janeiro 2025

What Are FICA Taxes And Why Do They Matter? - Quikaid16 janeiro 2025 -

What it means: COVID-19 Deferral of Employee FICA Tax16 janeiro 2025

What it means: COVID-19 Deferral of Employee FICA Tax16 janeiro 2025 -

FICA TAX PROVISIONS (1967-1980)16 janeiro 2025

FICA TAX PROVISIONS (1967-1980)16 janeiro 2025 -

Unveiling the Mysteries of Medicare Tax: Employer & Employee Tax16 janeiro 2025

Unveiling the Mysteries of Medicare Tax: Employer & Employee Tax16 janeiro 2025

você pode gostar

-

The Silent Hill 2 Novel, Wiki16 janeiro 2025

The Silent Hill 2 Novel, Wiki16 janeiro 2025 -

Venha Jogar BLOX FRUITS!, Chat Público16 janeiro 2025

Venha Jogar BLOX FRUITS!, Chat Público16 janeiro 2025 -

MahJongg Download - Moraff's MahJongg16 janeiro 2025

MahJongg Download - Moraff's MahJongg16 janeiro 2025 -

51 ideias de fantasias de Halloween que são um horror e tutoriais16 janeiro 2025

51 ideias de fantasias de Halloween que são um horror e tutoriais16 janeiro 2025 -

RBLXWild on X: Its time for a huge giveaway 💰 5x 10,000 RBLXWild16 janeiro 2025

RBLXWild on X: Its time for a huge giveaway 💰 5x 10,000 RBLXWild16 janeiro 2025 -

Rubinstein-Taybi syndrome: MedlinePlus Genetics16 janeiro 2025

Rubinstein-Taybi syndrome: MedlinePlus Genetics16 janeiro 2025 -

Fundo Papel De Parede Para Celular Xadrez Claro Papel de Parede16 janeiro 2025

Fundo Papel De Parede Para Celular Xadrez Claro Papel de Parede16 janeiro 2025 -

Bagulhos Sinistros16 janeiro 2025

-

Idk what happened16 janeiro 2025

-

Galax India, Galax Gaming Products, Galax Gaming Graphics Card16 janeiro 2025

Galax India, Galax Gaming Products, Galax Gaming Graphics Card16 janeiro 2025