Tie Breaker Rule in Tax Treaties

Por um escritor misterioso

Last updated 10 março 2025

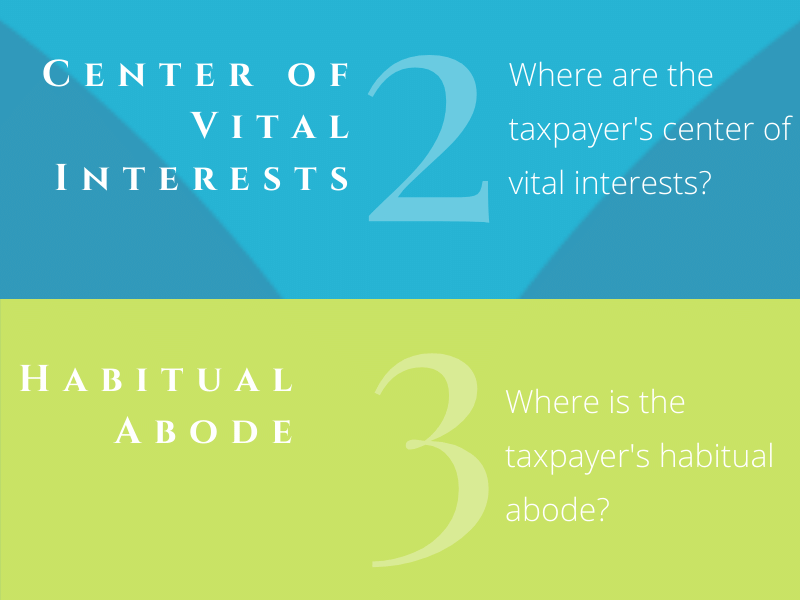

Hello Connections, Let’s briefly discuss the Tie Breaker Rule in Tax Treaties. Tie Breaker Rule are used when an individual becomes resident in both contracting states due to their domestic laws/rules, to determine the residential status of such individual for the purpose of taxability of income.

Cross Border Transactions and Tax Treaties - PDF Free Download

BoldenITS – Just another WordPress site

Canada US Tax Treaty Residency Tie-Breaker Rules - US & Canadian Cross-Border Tax Service - Cross-Border Financial Professional Corporation

How To Handle Dual Residents: IRS Tiebreakers

Article 4 (DTAA) - Concept of Residence - 2023 - Sorting Tax

International Taxation

Who Claims a Child on Taxes With 50/50 Custody? - SmartAsset

Tax residency: Determining Tax Residency: A Guide through Tax Treaties - FasterCapital

%20(2).png)

What To Do If You Satisfy More Than One Country's Tax Residency Test

Article 4(2) - Tie breaker Rule in case of an individual - +91-9667714335

Residency: Determining Residency: Exploring Tax Treaties - FasterCapital

Recomendado para você

-

/pic966113.jpg) TieBreaker, Board Game10 março 2025

TieBreaker, Board Game10 março 2025 -

Tie Breaker water park to close for 2022 season, News10 março 2025

Tie Breaker water park to close for 2022 season, News10 março 2025 -

Oakley Tie Breaker OO4108 41081810 março 2025

Oakley Tie Breaker OO4108 41081810 março 2025 -

Break-Off Tools — Steel Dog10 março 2025

Break-Off Tools — Steel Dog10 março 2025 -

Premium Tie Breaker - Product Detail Page10 março 2025

Premium Tie Breaker - Product Detail Page10 março 2025 -

Tie Break Tens (@tiebreaktens) / X10 março 2025

Tie Break Tens (@tiebreaktens) / X10 março 2025 -

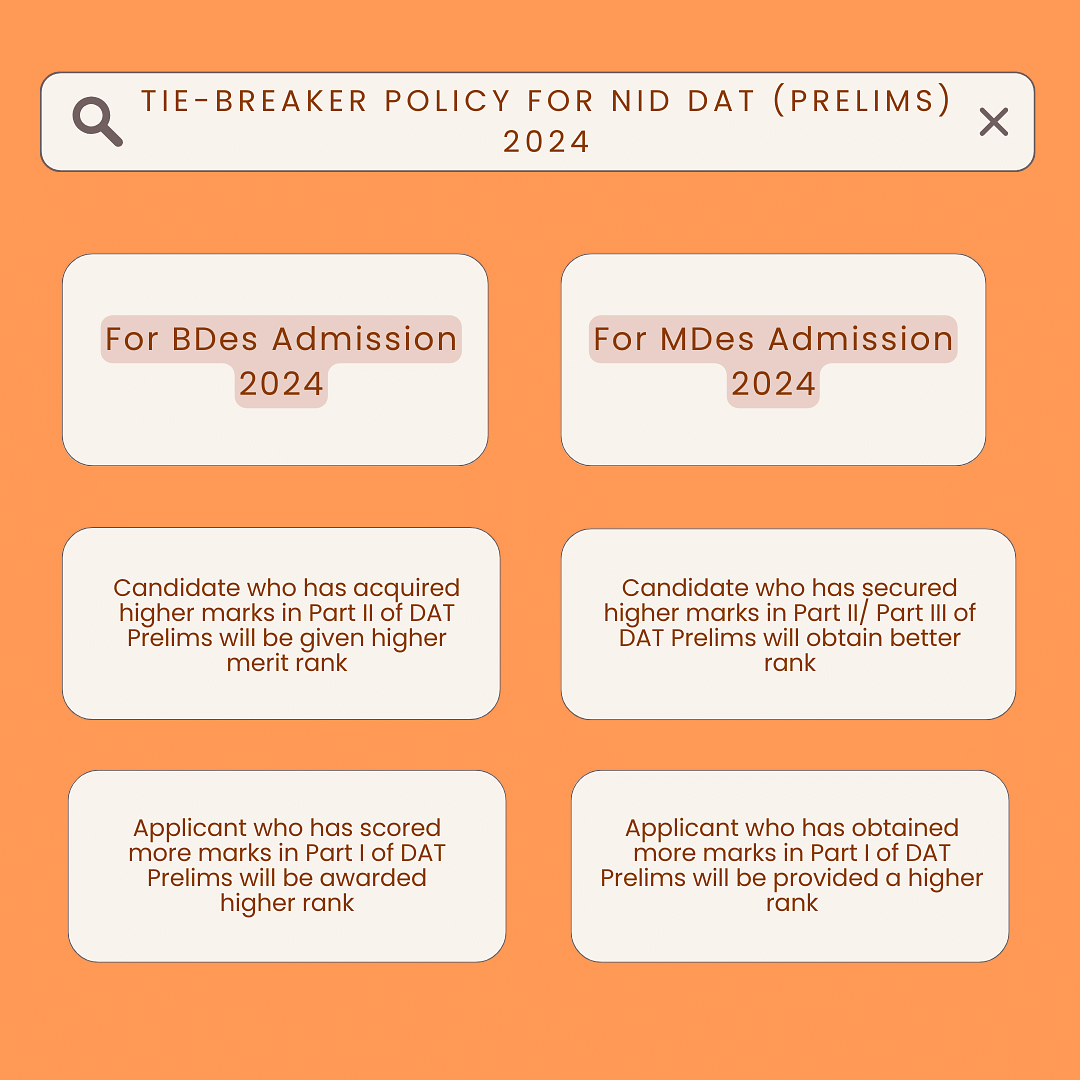

NID 2024 Tie-Breaker Policy10 março 2025

NID 2024 Tie-Breaker Policy10 março 2025 -

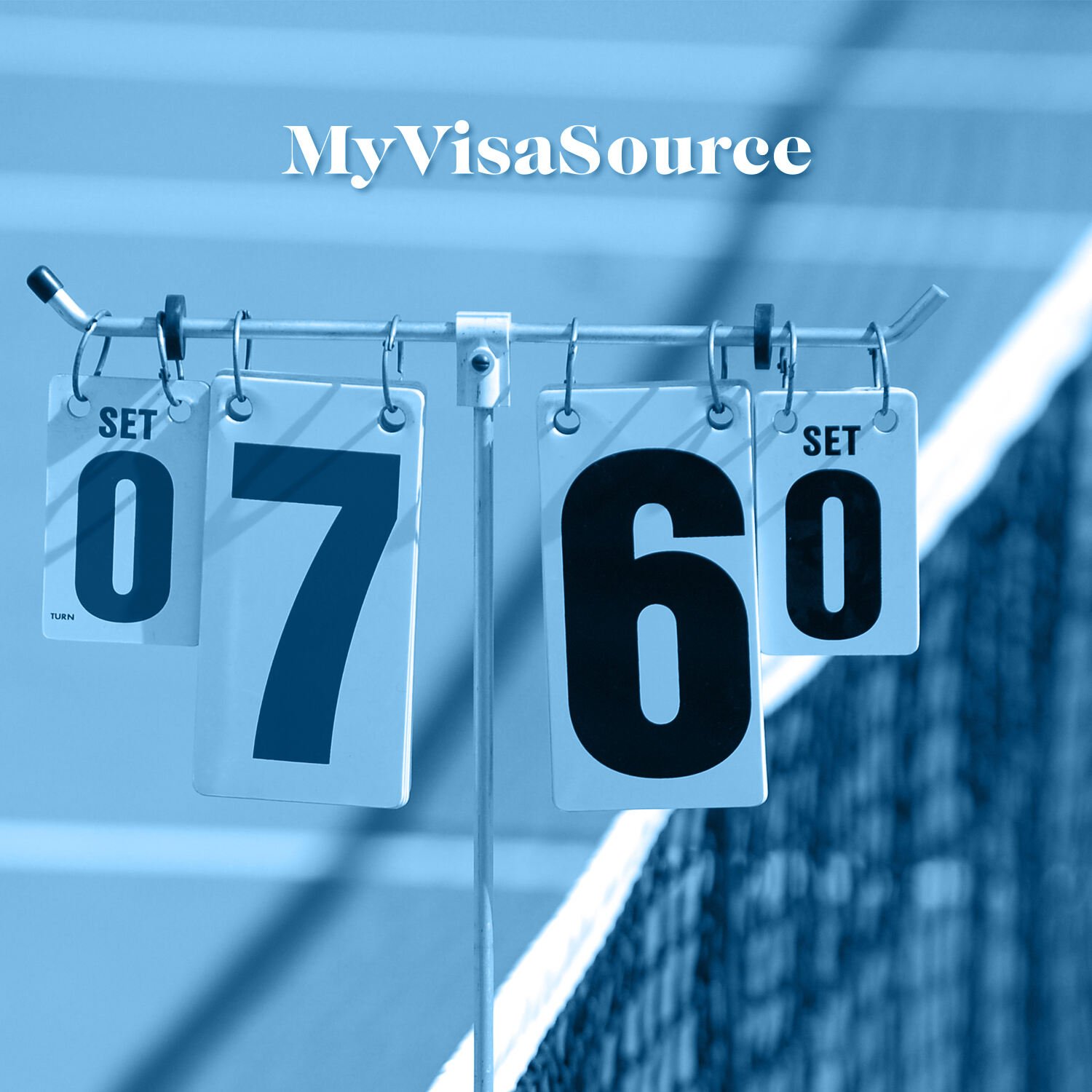

How Does the Express Entry Tie Breaker Rule Work?10 março 2025

How Does the Express Entry Tie Breaker Rule Work?10 março 2025 -

Jeopardy! 1984 Style Tie Breaker Logo by ThePatrickinator on DeviantArt10 março 2025

Jeopardy! 1984 Style Tie Breaker Logo by ThePatrickinator on DeviantArt10 março 2025 -

Tie Breaker CQC - Hand Crafted Fighting Knife — Applied Defense Concepts10 março 2025

Tie Breaker CQC - Hand Crafted Fighting Knife — Applied Defense Concepts10 março 2025

você pode gostar

-

FC Arsenal Tula: 11 Football Club Facts10 março 2025

FC Arsenal Tula: 11 Football Club Facts10 março 2025 -

Jogando Xadrez, O Início Do Jogo. O Primeiro Movimento É Um Peão Branco. Esperando Pela Etapa De Resposta. Fundo Verde, Vinheta. Foto Royalty Free, Gravuras, Imagens e Banco de fotografias. Image 9274156810 março 2025

Jogando Xadrez, O Início Do Jogo. O Primeiro Movimento É Um Peão Branco. Esperando Pela Etapa De Resposta. Fundo Verde, Vinheta. Foto Royalty Free, Gravuras, Imagens e Banco de fotografias. Image 9274156810 março 2025 -

Guide For Jacksmith APK for Android Download10 março 2025

Guide For Jacksmith APK for Android Download10 março 2025 -

Marvel Spider-Man Titan Hero Series Spider-Man (Miles Morales10 março 2025

Marvel Spider-Man Titan Hero Series Spider-Man (Miles Morales10 março 2025 -

Gaz Up - Alto Verão 2011/2012: 201110 março 2025

Gaz Up - Alto Verão 2011/2012: 201110 março 2025 -

Is that a - Roblox10 março 2025

-

new roblox condo game grave|TikTok Search10 março 2025

new roblox condo game grave|TikTok Search10 março 2025 -

Doki Doki Literature Club - Game Club - Book Clubs - WaniKani10 março 2025

Doki Doki Literature Club - Game Club - Book Clubs - WaniKani10 março 2025 -

Friday Night Funkin' TBH Creature Yippee Curseur – Custom Cursor10 março 2025

Friday Night Funkin' TBH Creature Yippee Curseur – Custom Cursor10 março 2025 -

Todos Episódios Yu-Gi-Oh! Dublado - Animes Online10 março 2025

Todos Episódios Yu-Gi-Oh! Dublado - Animes Online10 março 2025