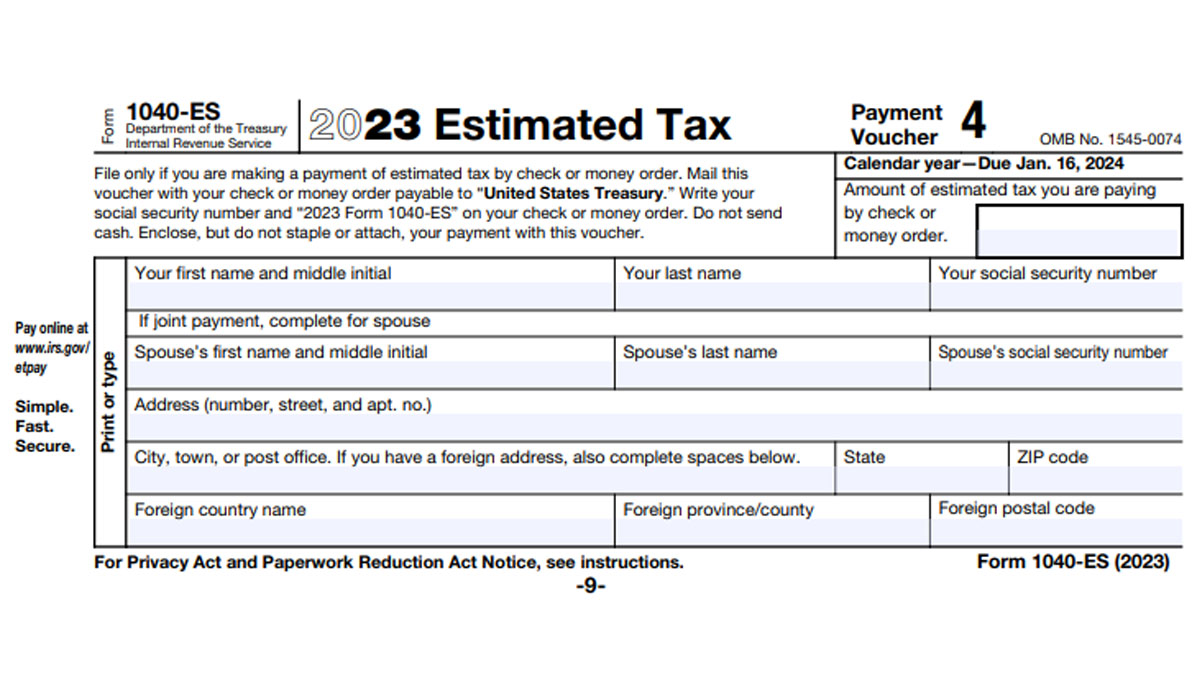

Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One

Por um escritor misterioso

Last updated 31 janeiro 2025

:max_bytes(150000):strip_icc()/Term-Definitions_Underpayment-penalty-Resized-7d6a14e797ad4b1584b7f659fff3a568.jpg)

An underpayment penalty is an IRS fee for failing to pay enough of your total tax liability during the year. Here’s how to determine if you owe an underpayment penalty.

6 Common IRS Penalties and How to Avoid Them

IRS Underpayment Penalties and How to Avoid Them

How Retirees Can Avoid Paying Quarterly Taxes Without Getting Penalized – Financial Success MD

What is an IRS Accuracy Related Penalty?

Use These 3 Tips to Avoid Estimated Tax Penalties - SH Block Tax Services

:max_bytes(150000):strip_icc()/Term-Definitions_Underpayment-penalty-Resized-7d6a14e797ad4b1584b7f659fff3a568.jpg)

Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One

What Happens If You Miss a Quarterly Estimated Tax Payment?

Recomendado para você

-

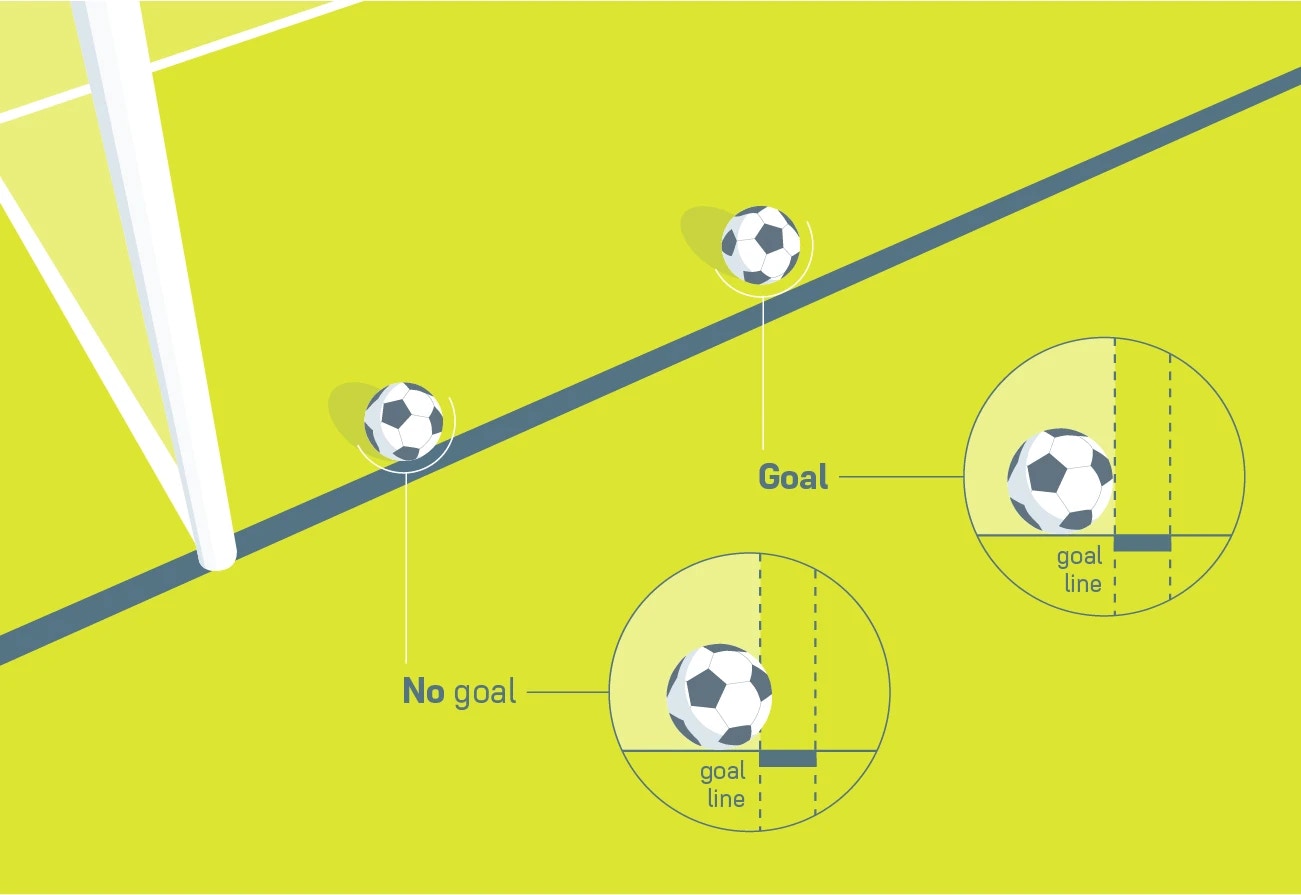

Women's World Cup 2023: Controversial VAR decision condemns USWNT in penalty shootout against Sweden31 janeiro 2025

Women's World Cup 2023: Controversial VAR decision condemns USWNT in penalty shootout against Sweden31 janeiro 2025 -

Penalty kick (association football) - Wikipedia31 janeiro 2025

Penalty kick (association football) - Wikipedia31 janeiro 2025 -

The tricky physics of taking the perfect World Cup penalty31 janeiro 2025

The tricky physics of taking the perfect World Cup penalty31 janeiro 2025 -

Penalty Box in Soccer: Understanding the Penalty Box31 janeiro 2025

Penalty Box in Soccer: Understanding the Penalty Box31 janeiro 2025 -

The Best Penalty Takers in the Premier League31 janeiro 2025

The Best Penalty Takers in the Premier League31 janeiro 2025 -

Get Penalty.Kicks31 janeiro 2025

-

Final Penalty Kick Clinches 2022 World Cup for Argentina (Video31 janeiro 2025

Final Penalty Kick Clinches 2022 World Cup for Argentina (Video31 janeiro 2025 -

How to score a penalty in EA FC 24: Tips & tricks for penalties31 janeiro 2025

How to score a penalty in EA FC 24: Tips & tricks for penalties31 janeiro 2025 -

Law 10 - The Outcome of a Match31 janeiro 2025

Law 10 - The Outcome of a Match31 janeiro 2025 -

Penalty area - Wikipedia31 janeiro 2025

Penalty area - Wikipedia31 janeiro 2025

você pode gostar

-

duda games - Osasco, São Paulo, Brasil, Perfil profissional31 janeiro 2025

-

One Piece World Seeker Extra Episode 3: The Unfinished Map Trophy Guides and PSN Price History31 janeiro 2025

One Piece World Seeker Extra Episode 3: The Unfinished Map Trophy Guides and PSN Price History31 janeiro 2025 -

Google makes move to end console gaming by launching streaming31 janeiro 2025

Google makes move to end console gaming by launching streaming31 janeiro 2025 -

Como desenhar Kit de Maquiagem de Luxo, Pintando Desenhos31 janeiro 2025

Como desenhar Kit de Maquiagem de Luxo, Pintando Desenhos31 janeiro 2025 -

Cinema tem estreia para quem curte ficção científica e muita computação gráfica - Artes - Campo Grande News31 janeiro 2025

Cinema tem estreia para quem curte ficção científica e muita computação gráfica - Artes - Campo Grande News31 janeiro 2025 -

Tênis Mad Rats Mureta Marrom31 janeiro 2025

Tênis Mad Rats Mureta Marrom31 janeiro 2025 -

Team Z wallpapers I made : r/BlueLock31 janeiro 2025

Team Z wallpapers I made : r/BlueLock31 janeiro 2025 -

3d rendering of an anthem anime girl31 janeiro 2025

3d rendering of an anthem anime girl31 janeiro 2025 -

Total drama top 25 favorite characters by fcomendoza on DeviantArt31 janeiro 2025

Total drama top 25 favorite characters by fcomendoza on DeviantArt31 janeiro 2025 -

Castlevania: Lords of Shadow - Xbox 360, Xbox 36031 janeiro 2025