Overview of FICA Tax- Medicare & Social Security

Por um escritor misterioso

Last updated 04 março 2025

FICA represents the Federal Insurance Contributions Act, and it's a government tax that businesses and workers pay. FICA Taxes are the fundamental subsidizing focal point for Social Security benefits.

FICA tax rate 2022: How can you adjust you Social Security and

What is FICA Tax? - The TurboTax Blog

Family Finance Favs: Don't Leave Teens Wondering What The FICA?

FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset

What is the FICA Tax and How Does it Connect to Social Security?

Overview of FICA Tax- Medicare & Social Security

Why do FICA-SS and FICA-MC show as ZEROS on my Tax Deposit and 941

What is FICA

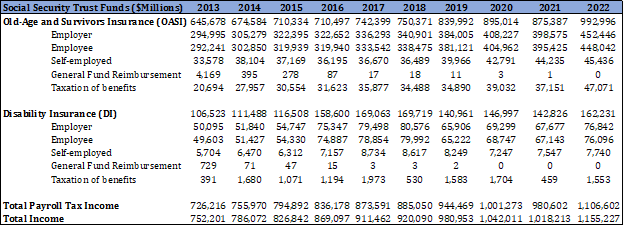

Social Security Financing: From FICA to the Trust Funds - AAF

Social Security, Medicare & Government Pensions - Legal Books - Nolo

FICA: Definition, 2022 Rates and Limits, Rules for Self-Employed

2017 FICA Tax: What You Need to Know

FICA and Withholding: Everything You Need to Know - TurboTax Tax

What Is And How To Calculate FICA Taxes Explained, Social Security

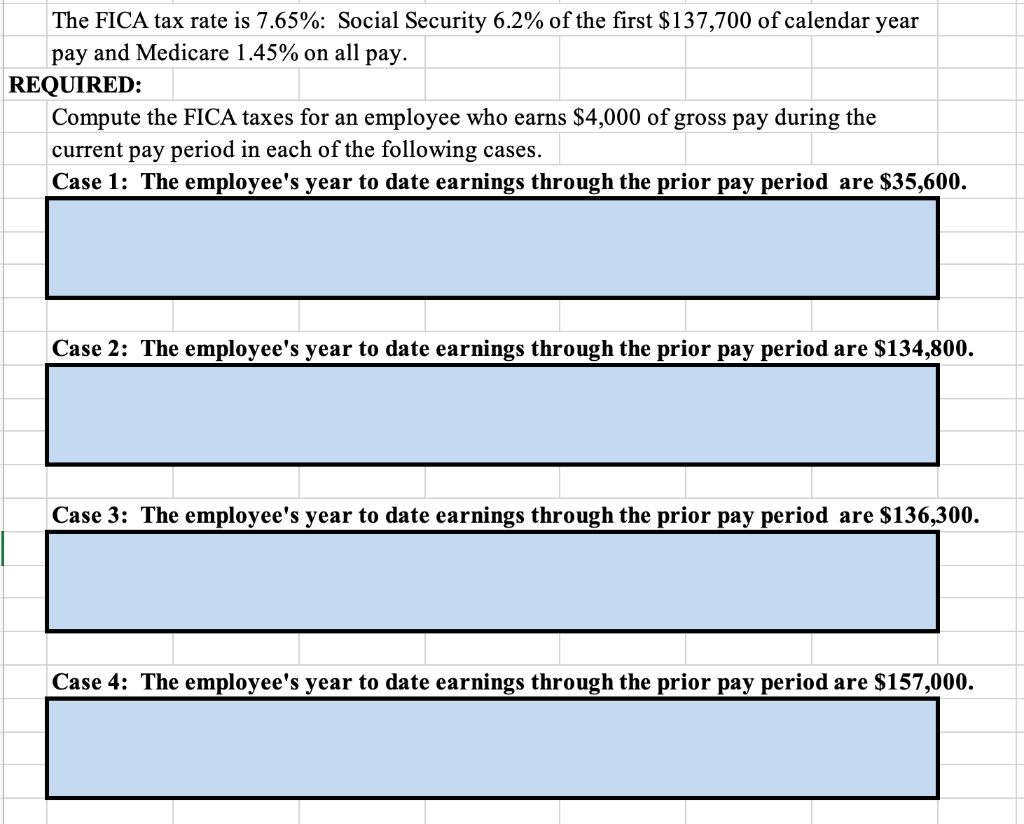

Solved The FICA tax rate is 7.65%: Social Security 6.2% of

Recomendado para você

-

What Is the FICA Tax and Why Does It Exist? - TheStreet04 março 2025

What Is the FICA Tax and Why Does It Exist? - TheStreet04 março 2025 -

FICA Tax Exemption for Nonresident Aliens Explained04 março 2025

FICA Tax Exemption for Nonresident Aliens Explained04 março 2025 -

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand04 março 2025

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand04 março 2025 -

What are FICA Tax Payable? – SuperfastCPA CPA Review04 março 2025

What are FICA Tax Payable? – SuperfastCPA CPA Review04 março 2025 -

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet04 março 2025

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet04 março 2025 -

What is the FICA Tax? - 2023 - Robinhood04 março 2025

-

What is the FICA Tax Refund?04 março 2025

What is the FICA Tax Refund?04 março 2025 -

Withholding FICA Tax on Nonresident employees and Foreign Workers04 março 2025

Withholding FICA Tax on Nonresident employees and Foreign Workers04 março 2025 -

How An S Corporation Reduces FICA Self-Employment Taxes04 março 2025

How An S Corporation Reduces FICA Self-Employment Taxes04 março 2025 -

How Do I Get a FICA Tax Refund for F1 Students?04 março 2025

How Do I Get a FICA Tax Refund for F1 Students?04 março 2025

você pode gostar

-

Rap americano 2024 ( Melhores Músicas de Rap internacionais mais04 março 2025

Rap americano 2024 ( Melhores Músicas de Rap internacionais mais04 março 2025 -

BSA Discord 💰 Brawl Stars Amino04 março 2025

BSA Discord 💰 Brawl Stars Amino04 março 2025 -

Team Liquid and Alienware Officially Open Alienware Training04 março 2025

Team Liquid and Alienware Officially Open Alienware Training04 março 2025 -

Pocket Monsters (2019) Episódio 12: Batalha de Daimax! Dande, o04 março 2025

Pocket Monsters (2019) Episódio 12: Batalha de Daimax! Dande, o04 março 2025 -

tiara gatinho eva Tiara de gatinho, Tiara, Tiaras carnaval04 março 2025

tiara gatinho eva Tiara de gatinho, Tiara, Tiaras carnaval04 março 2025 -

Figure, THE FOUNDATION OFFICIAL WIKI04 março 2025

Figure, THE FOUNDATION OFFICIAL WIKI04 março 2025 -

QUAL É O MELHOR GOD OF WAR?04 março 2025

QUAL É O MELHOR GOD OF WAR?04 março 2025 -

PlayStation Now: the best streaming games04 março 2025

-

Blox Fruit Plush Toy Blox Fruit Deluxe Mystery Plush Stuffed Animals Dragon New Blox Fruit Mammoth Doll Soft Toy Pillow Gift - AliExpress04 março 2025

Blox Fruit Plush Toy Blox Fruit Deluxe Mystery Plush Stuffed Animals Dragon New Blox Fruit Mammoth Doll Soft Toy Pillow Gift - AliExpress04 março 2025 -

ANJOSIRMA YY Shape 2D Cílios 0.05/0.07 Faux Mink C/D 8-15mm04 março 2025