Tackling the tax code: Efficient and equitable ways to raise revenue

Por um escritor misterioso

Last updated 25 dezembro 2024

This book presents new proposals for a value-added tax, a financial transactions tax, wealth and inheritance taxes, reforming the corporate and international tax systems, and giving the Internal Revenue Service the resources it needs to ensure that tax laws are better enforced and administered.

:max_bytes(150000):strip_icc()/Marginal_Tax_Rate_Final-7cae08bcc3934971b56e7650050f99f1.jpg)

Marginal Tax Rate: What It Is and How to Calculate It, With Examples

Tackling the Tax Code: Efficient and Equitable Ways to Raise

10 Tax Reforms for Economic Growth and Opportunity

Towards a new tax system in Ukraine

Tackling the tax code: Efficient and equitable ways to raise

Paris Declaration: a Global Call for Investing in the Futures of

:max_bytes(150000):strip_icc()/Value-Added-Tax-bfc9359a52f74ae9a430d4c2d7ce91e2.jpg)

Value-Added Tax (VAT)

How the Federal Tax Code Can Better Advance Racial Equity

Proceedings, Free Full-Text

Sustainability, Free Full-Text

Tax evasion: Wealth Tax: A Solution to Combat Tax Evasion

India's PE/VC market: The quest for refined performance metrics

Recomendado para você

-

Watch El marginal Netflix Official Site25 dezembro 2024

Watch El marginal Netflix Official Site25 dezembro 2024 -

Anime News And Facts on X: THE MARGINAL SERVICE Original TV anime announced - Airs 2023 - Studio 3Hz / X25 dezembro 2024

Anime News And Facts on X: THE MARGINAL SERVICE Original TV anime announced - Airs 2023 - Studio 3Hz / X25 dezembro 2024 -

Chapter 1: Foundation of Economics Flashcards25 dezembro 2024

Chapter 1: Foundation of Economics Flashcards25 dezembro 2024 -

Macroeconomics: Chapter 1 Question & Answers Best Rated A+., Exams Nursing25 dezembro 2024

Macroeconomics: Chapter 1 Question & Answers Best Rated A+., Exams Nursing25 dezembro 2024 -

Marginal Benefit Economics, Definition, Principle & Examples - Video & Lesson Transcript25 dezembro 2024

Marginal Benefit Economics, Definition, Principle & Examples - Video & Lesson Transcript25 dezembro 2024 -

Economics25 dezembro 2024

-

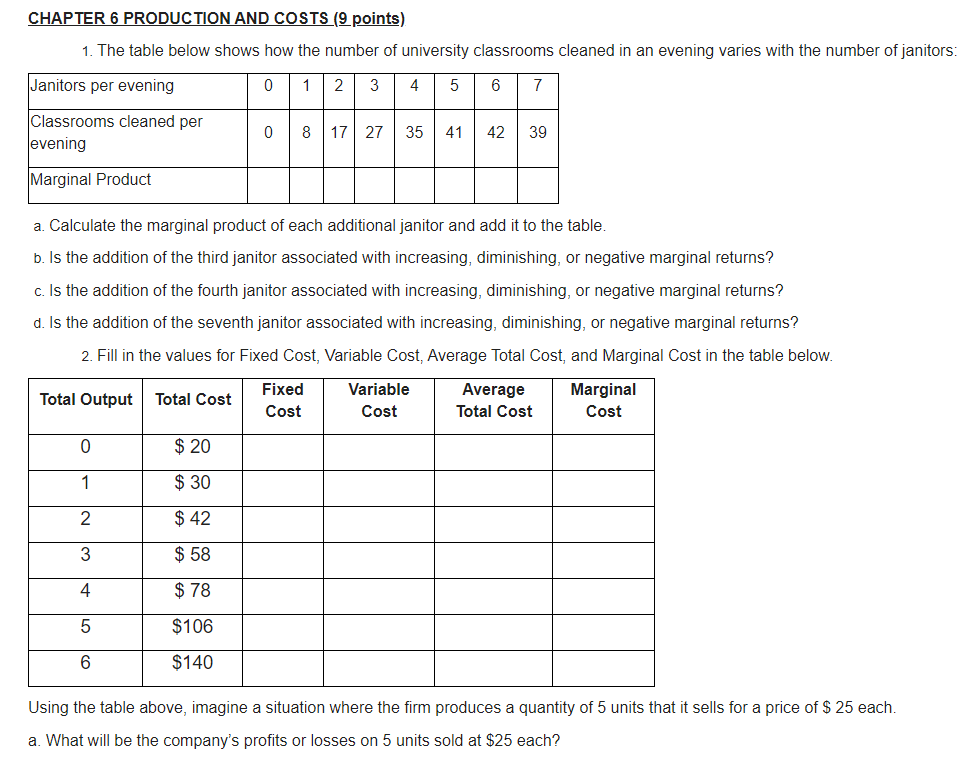

Solved CHAPTER 6 PRODUCTION AND COSTS (9 points) 1. The25 dezembro 2024

Solved CHAPTER 6 PRODUCTION AND COSTS (9 points) 1. The25 dezembro 2024 -

C H A P T E R 1 Statement of the Problem, Evaluating Federal Research Programs: Research and the Government Performance and Results Act25 dezembro 2024

C H A P T E R 1 Statement of the Problem, Evaluating Federal Research Programs: Research and the Government Performance and Results Act25 dezembro 2024 -

ACCA Note and Mock Exam25 dezembro 2024

-

Migration Management? - Chapter 1. Labor migration flows to Ragusa: the fuzzy boundaries between cores and peripheries - Graduate Institute Publications25 dezembro 2024

Migration Management? - Chapter 1. Labor migration flows to Ragusa: the fuzzy boundaries between cores and peripheries - Graduate Institute Publications25 dezembro 2024

você pode gostar

-

Position crashed Stockfish 16 · Issue #4817 · official-stockfish/Stockfish · GitHub25 dezembro 2024

-

Bokura wa Minna Kawaisou, Vol.1: 9784785936310: Ruri Miyahara: Arts, Crafts & Sewing25 dezembro 2024

Bokura wa Minna Kawaisou, Vol.1: 9784785936310: Ruri Miyahara: Arts, Crafts & Sewing25 dezembro 2024 -

Tom Clancy's Splinter Cell Blacklist PC Video Game Review - Benchmark Reviews @TechPlayboy25 dezembro 2024

Tom Clancy's Splinter Cell Blacklist PC Video Game Review - Benchmark Reviews @TechPlayboy25 dezembro 2024 -

![Putt Party: Get your friends on Discord for some wacky mini-golf! [ENG/ESP]](https://images.hive.blog/0x0/https://files.peakd.com/file/peakd-hive/acstriker/242hcjLrHRiohL1Lfko93Nmt28ML3VGLY72vgKZGM4qfit4vt7UCBoPP6r25zLX1Jng8E.png) Putt Party: Get your friends on Discord for some wacky mini-golf! [ENG/ESP]25 dezembro 2024

Putt Party: Get your friends on Discord for some wacky mini-golf! [ENG/ESP]25 dezembro 2024 -

Hogwarts Legacy - Download25 dezembro 2024

Hogwarts Legacy - Download25 dezembro 2024 -

AFO Combines Every Single Quirk For An Ultimate Attack - My Hero25 dezembro 2024

AFO Combines Every Single Quirk For An Ultimate Attack - My Hero25 dezembro 2024 -

Como lutar contra o Reptile no Mortal Kombat com Scorpion e Liu Kang25 dezembro 2024

Como lutar contra o Reptile no Mortal Kombat com Scorpion e Liu Kang25 dezembro 2024 -

![OFFICIAL] Betfullstar - Discover the colorful world of puzzles for](https://www.betfullstar.com/product/global/images/Cardaa.jpg) OFFICIAL] Betfullstar - Discover the colorful world of puzzles for25 dezembro 2024

OFFICIAL] Betfullstar - Discover the colorful world of puzzles for25 dezembro 2024 -

Shoot Em - Play Online on SilverGames 🕹️25 dezembro 2024

Shoot Em - Play Online on SilverGames 🕹️25 dezembro 2024 -

Minecraft icon Sapnap shocks the online community by signing with Kick, Dream, Punz, and more react25 dezembro 2024

Minecraft icon Sapnap shocks the online community by signing with Kick, Dream, Punz, and more react25 dezembro 2024