Publication 970 (2022), Tax Benefits for Education

Por um escritor misterioso

Last updated 27 janeiro 2025

Publication 970 - Introductory Material Future Developments What's New Reminders

TAS Tax Tip: Tax resources for individuals filing a federal income tax return for the first time - TAS

Coverdell Education Savings Account: Exploring the Details in IRS Pub 970 - FasterCapital

The Law Student Tax Toolbox - Nationaljurist

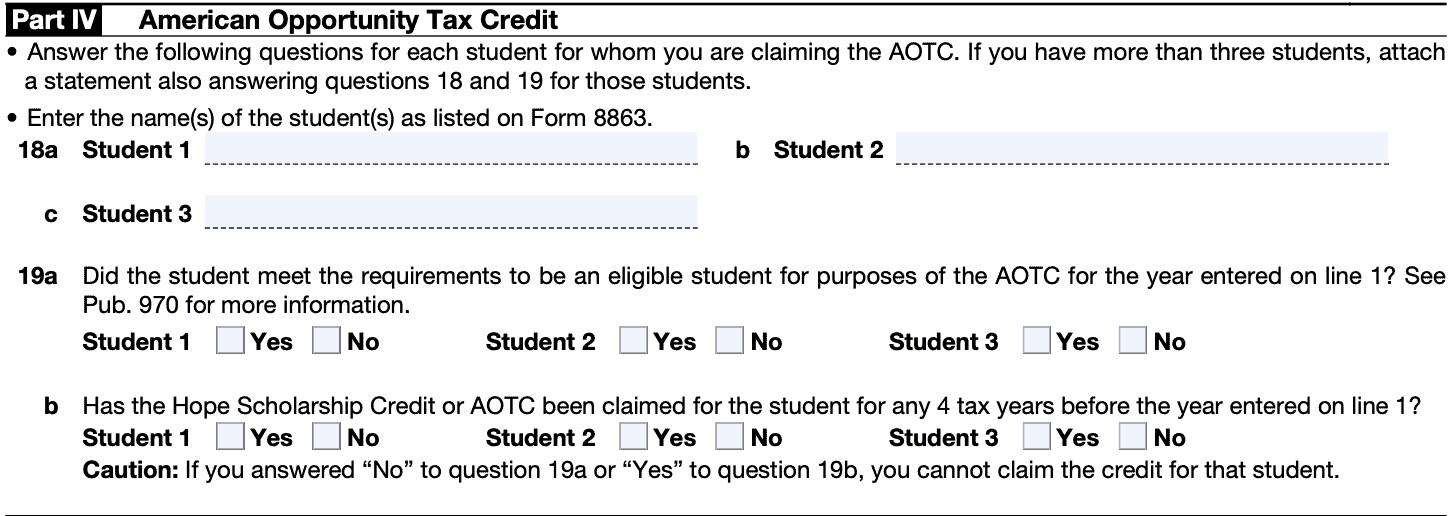

IRS Form 8863 Instructions

Sher's Tax & Accounting LLC

How to Pay for College for a Grandchild or Someone Else, Grandparents Paying for College

Educator expense tax deduction increases for 2022 returns

Form 8917: Tuition and Fees Deduction: What it is, How it Works

Education Tax Credits – Get It Back

Maximizing the higher education tax credits - Journal of Accountancy

New 2022 IRS Income Tax Brackets And Phaseouts For Education Tax Breaks

Do You Have to Report VA Disability as Income for 2023 Taxes? - Hill & Ponton, P.A.

IRS Form 8862 Instructions

What to know about tax credits for education

Recomendado para você

-

Pin by Alex Adams on Body language27 janeiro 2025

Pin by Alex Adams on Body language27 janeiro 2025 -

samrend User Profile27 janeiro 2025

samrend User Profile27 janeiro 2025 -

back to school chapter|TikTok Search27 janeiro 2025

back to school chapter|TikTok Search27 janeiro 2025 -

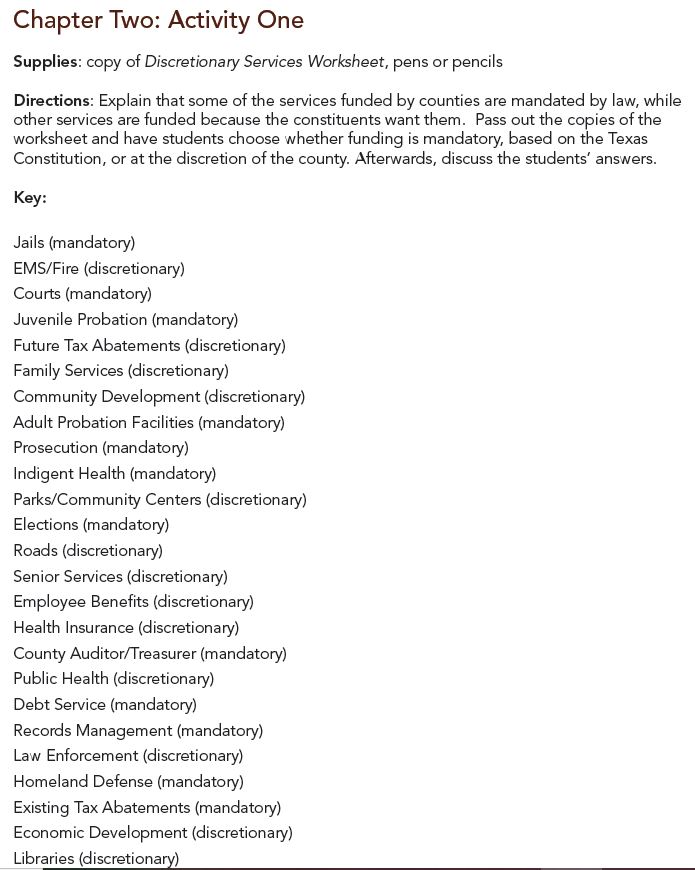

Back To School Basics - Discretionary Services Answers - Texas County Progress27 janeiro 2025

Back To School Basics - Discretionary Services Answers - Texas County Progress27 janeiro 2025 -

Chapter 1 - Introduction: Why This Resource with Community Tools?, Community Tools to Improve Transportation Options for Veterans, Military Service Members, and Their Families27 janeiro 2025

Chapter 1 - Introduction: Why This Resource with Community Tools?, Community Tools to Improve Transportation Options for Veterans, Military Service Members, and Their Families27 janeiro 2025 -

Chapter 127 janeiro 2025

Chapter 127 janeiro 2025 -

![Contos da Disney & Outros [TRADUÇÃO PT-BR]](https://i.pinimg.com/474x/22/d9/25/22d925f3815bab5a9502ed5e1d0582f1.jpg) Contos da Disney & Outros [TRADUÇÃO PT-BR]27 janeiro 2025

Contos da Disney & Outros [TRADUÇÃO PT-BR]27 janeiro 2025 -

1 Peter Book I: Chapter 1: Volume 23 of Heavenly Citizens in Earthly Shoes, An Exposition of the Scriptures for Disciples and Young Christians27 janeiro 2025

1 Peter Book I: Chapter 1: Volume 23 of Heavenly Citizens in Earthly Shoes, An Exposition of the Scriptures for Disciples and Young Christians27 janeiro 2025 -

Nook buyers getting $100 of free classic books - CNET27 janeiro 2025

Nook buyers getting $100 of free classic books - CNET27 janeiro 2025 -

CLASS 8 MATHS, BACK TO SCHOOL SERIES, CHAPTER 1, EQUAL TRIANGLE, തുല്ല്യ ത്രികോണങ്ങൾ27 janeiro 2025

CLASS 8 MATHS, BACK TO SCHOOL SERIES, CHAPTER 1, EQUAL TRIANGLE, തുല്ല്യ ത്രികോണങ്ങൾ27 janeiro 2025

você pode gostar

-

Soma Yukihira :: AniGame - Guide & Database27 janeiro 2025

Soma Yukihira :: AniGame - Guide & Database27 janeiro 2025 -

Jaguah Residence - Jaguaribe, Salvador27 janeiro 2025

Jaguah Residence - Jaguaribe, Salvador27 janeiro 2025 -

TOC: Weekly Shonen Magazine #11 (Ano 2021) - Analyse It27 janeiro 2025

TOC: Weekly Shonen Magazine #11 (Ano 2021) - Analyse It27 janeiro 2025 -

Even Apple's ex-head of app reviews says App Store is unfair to27 janeiro 2025

Even Apple's ex-head of app reviews says App Store is unfair to27 janeiro 2025 -

Metralhadora 24 Tiros Nerf, Brinquedo Nerf Usado 6173394327 janeiro 2025

-

Throne And Liberty Alpha Tester Leak - MMO Wiki27 janeiro 2025

Throne And Liberty Alpha Tester Leak - MMO Wiki27 janeiro 2025 -

Gucci outlet finds! You must check out the Woodbury Commons outlet. So, Gucci27 janeiro 2025

-

dakotavasquez82 - Statistics · TwitchTracker27 janeiro 2025

dakotavasquez82 - Statistics · TwitchTracker27 janeiro 2025 -

Alice in Borderland Site oficial da Netflix27 janeiro 2025

Alice in Borderland Site oficial da Netflix27 janeiro 2025 -

News and Information Empire State University27 janeiro 2025

News and Information Empire State University27 janeiro 2025