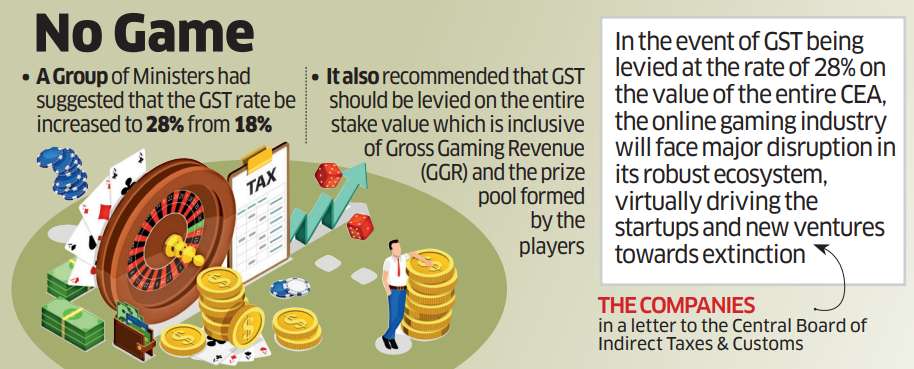

Online gaming industry for 28% GST on gross gaming revenue not on entry amount

Por um escritor misterioso

Last updated 03 março 2025

GGR is the fee charged by an online skill gaming platform as service charges to facilitate the participation of players in a game on their platform while Contest Entry Amount (CEA) is the entire amount deposited by the player to enter a contest on the platform.

Online gaming likely to attract 28% GST, see tweak in calculation

How 28% GST can be the death knell for India's gaming industry

RIP - Real money gaming” says online gaming industry over 28% GST

Will 28% GST kill the online gaming industry in India?

India Levies 28% Tax on Online Gaming - 4 of the Top Platforms

gst: Top gaming firms urge government not to raise GST rate to 28

The online gaming industry attracts 28% GST on gross gaming

GST's Pause Button on Gaming Industry's Future: An Explainer

News

Recomendado para você

-

![Best Cloud Gaming Services of 2023 [Shadow PC & Alternatives]](https://www.cloudwards.net/wp-content/uploads/2019/10/geforce-now-application.png) Best Cloud Gaming Services of 2023 [Shadow PC & Alternatives]03 março 2025

Best Cloud Gaming Services of 2023 [Shadow PC & Alternatives]03 março 2025 -

The Rise of Gameschooling: New Virtual Convention to Celebrate Students & Game Designers Finding Fun Ways to Learn – The 7403 março 2025

The Rise of Gameschooling: New Virtual Convention to Celebrate Students & Game Designers Finding Fun Ways to Learn – The 7403 março 2025 -

5 Free Online Game Platforms To Play With Your Friends03 março 2025

5 Free Online Game Platforms To Play With Your Friends03 março 2025 -

The video game platform Roblox says it's back online after outage03 março 2025

The video game platform Roblox says it's back online after outage03 março 2025 -

Top 6 Popular Gaming Streaming Sites in 2023 - EaseUS03 março 2025

Top 6 Popular Gaming Streaming Sites in 2023 - EaseUS03 março 2025 -

Online Gaming Platform Provider - Kubus03 março 2025

Online Gaming Platform Provider - Kubus03 março 2025 -

How Online Gaming Platforms Are Helping Charities in Fundraising in India03 março 2025

How Online Gaming Platforms Are Helping Charities in Fundraising in India03 março 2025 -

How gaming platforms have become the new social media03 março 2025

How gaming platforms have become the new social media03 março 2025 -

Online Gaming Platform Solution Market Size, Share, Trends 2024-203203 março 2025

Online Gaming Platform Solution Market Size, Share, Trends 2024-203203 março 2025 -

How to protect your online gaming platform from ID frauds?03 março 2025

How to protect your online gaming platform from ID frauds?03 março 2025

você pode gostar

-

SVG > tóxico Atenção símbolo risco biológico - Imagem e ícone03 março 2025

-

Dragon Age Origins: Blood Mage by beethy on DeviantArt03 março 2025

Dragon Age Origins: Blood Mage by beethy on DeviantArt03 março 2025 -

HSP 94123 RC Car 4WD 2.4G 540Motor On Road Drifting RC Car03 março 2025

HSP 94123 RC Car 4WD 2.4G 540Motor On Road Drifting RC Car03 março 2025 -

Janelas de PVC - A maior durabilidade e redução de ruídos03 março 2025

Janelas de PVC - A maior durabilidade e redução de ruídos03 março 2025 -

Looking back to the endlessly entertaining Sleeping Dogs03 março 2025

Looking back to the endlessly entertaining Sleeping Dogs03 março 2025 -

Terraria Murasama with Luxors Gift vs Calamity Mod Boss Rush Fail03 março 2025

Terraria Murasama with Luxors Gift vs Calamity Mod Boss Rush Fail03 março 2025 -

Who Is The Demon King, Muzan Kibutsuji? #muzankibutsuji #muzan03 março 2025

-

De bom onder Brussel by Jobs & Careers CV - Issuu03 março 2025

De bom onder Brussel by Jobs & Careers CV - Issuu03 março 2025 -

Some thoughts regarding r/chess's views on Ding Liren playing games to reach the minimum threshold necessary to qualify for the Candidates : r/chess03 março 2025

Some thoughts regarding r/chess's views on Ding Liren playing games to reach the minimum threshold necessary to qualify for the Candidates : r/chess03 março 2025 -

GANHAR DINHEIRO PLATINANDO JOGOS? - PLAYSTATION STARS03 março 2025

GANHAR DINHEIRO PLATINANDO JOGOS? - PLAYSTATION STARS03 março 2025