Breaking Down The Impact Of UK's Value Added Tax On Sellers

Por um escritor misterioso

Last updated 24 fevereiro 2025

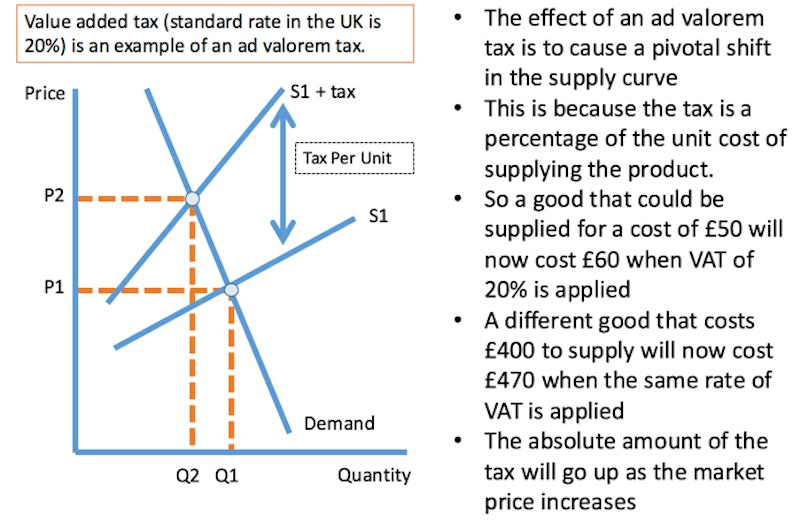

recently announced that sellers on its U.K. platform will be required to pay a 20% value-added tax on fees paid to the company beginning August this year. The new VAT is applicable to sellers that have annual turnover (sum total of all goods sold through the website) in excess of £85,000.

:max_bytes(150000):strip_icc()/dotdash-INV-final-How-the-Ideal-Tax-Rate-Is-Determined-The-Laffer-Curve-2021-01-9873ad4f5a464341aa6731540b763d76.jpg)

How the Ideal Tax Rate Is Determined: The Laffer Curve

What is VAT and how does it work?

:max_bytes(150000):strip_icc()/consumption-tax.asp_FINAL-96e3b673009d46b8b71253303e0efa38.png)

Consumption Tax: Definition, Types, vs. Income Tax

A Comparative Analysis of the VAT System of Developed and Developing Economies (UK and Nigeria)

Value Added Tax (VAT) - Overview, How To Calculate, Example

Shopify VAT: How To Do It Right [Guide + Useful Links]

NewsWire - Government to increase the VAT percentage up to 18% with effect from January 01, 2024.

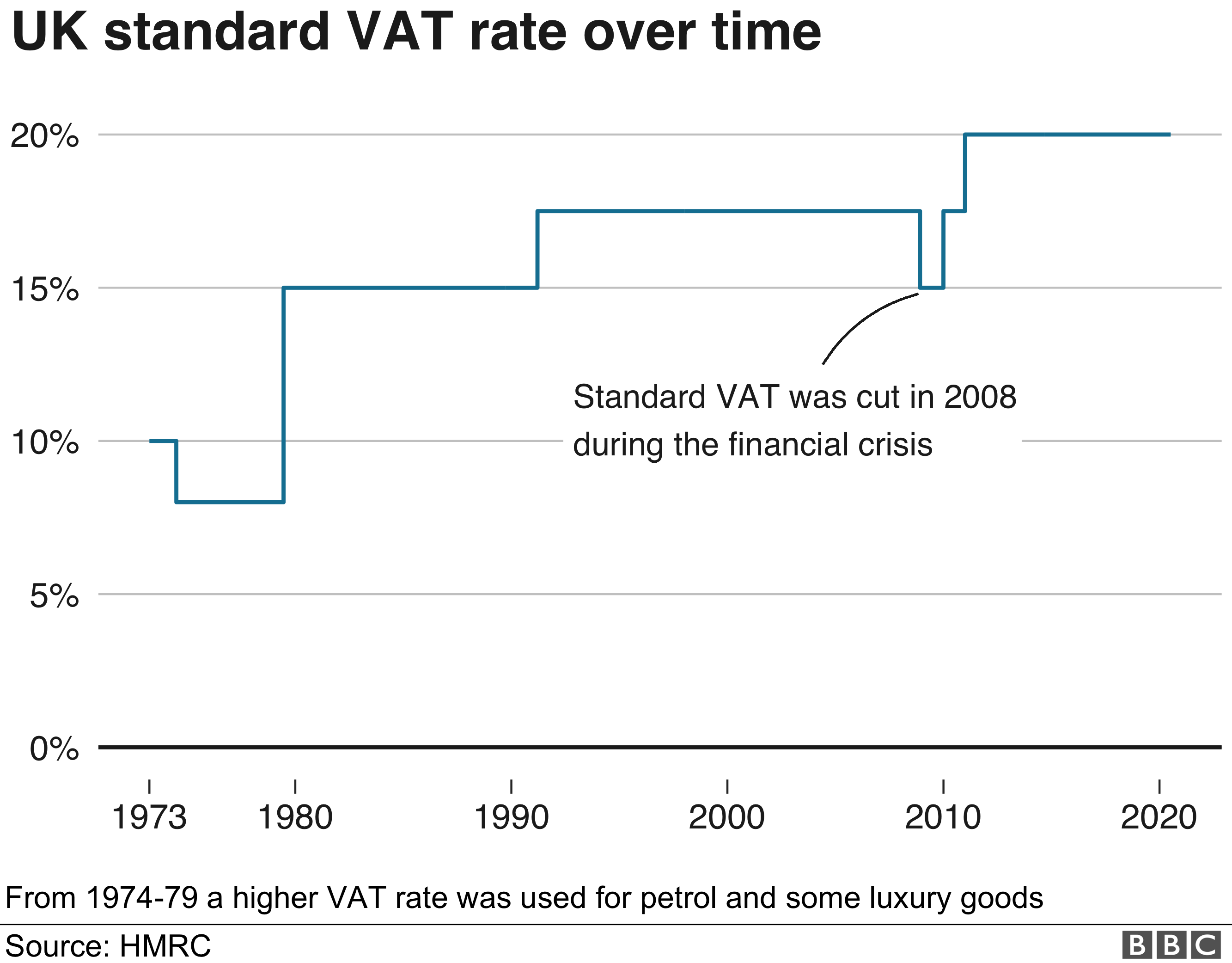

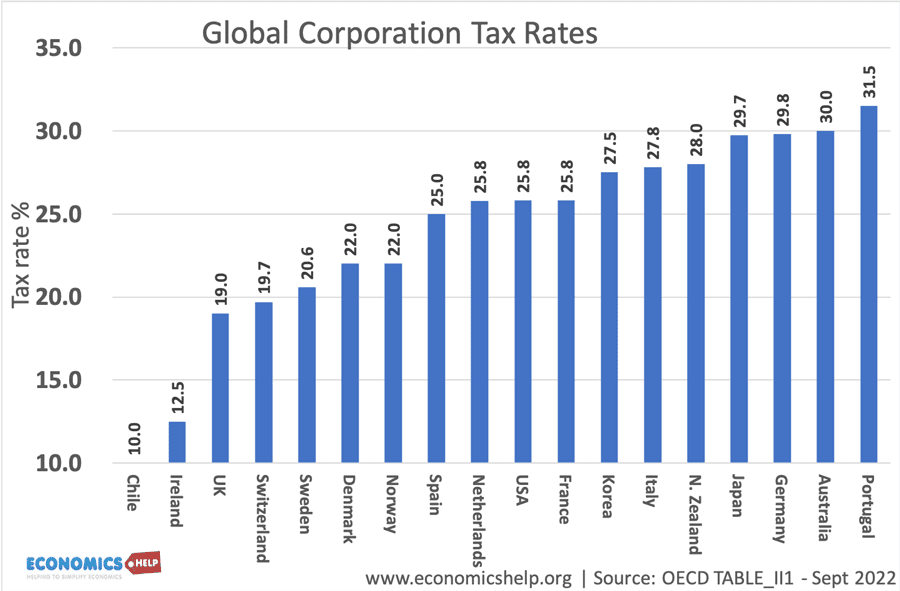

Micro and Macro Effects of Higher VAT (Edexcel 25 Mark Question), Economics

Value-added tax - Wikipedia

UK 50th Birthday Newspaper Poster 1973 Newspaper Poster 50

Indirect taxes

Crypto Tax UK: Expert Guide 2023

The effect of tax cuts on economic growth and revenue - Economics Help

Recomendado para você

-

.co.uk Kingston upon Thames24 fevereiro 2025

-

info dietgirlcouk24 fevereiro 2025

info dietgirlcouk24 fevereiro 2025 -

7 TIPS FOR SETTING UP BUSINESS ACCOUNT - Seed Formations24 fevereiro 2025

7 TIPS FOR SETTING UP BUSINESS ACCOUNT - Seed Formations24 fevereiro 2025 -

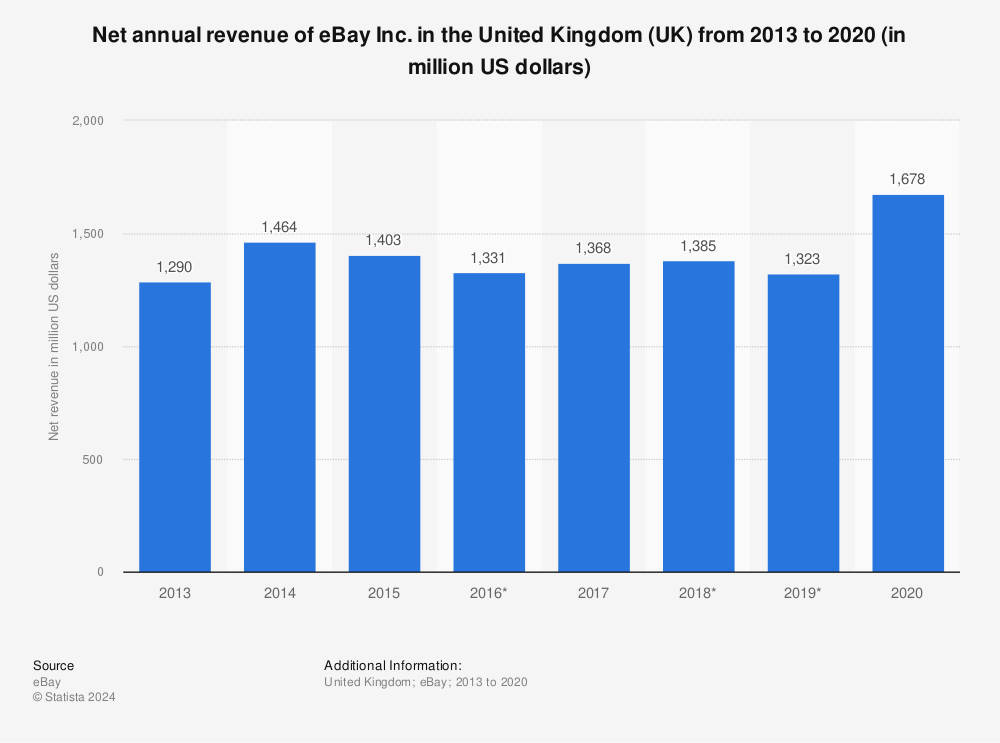

UK revenue from 2013-202024 fevereiro 2025

UK revenue from 2013-202024 fevereiro 2025 -

latest news, analysis and trading updates24 fevereiro 2025

latest news, analysis and trading updates24 fevereiro 2025 -

20% OFF: Coupons & Promo Codes24 fevereiro 2025

20% OFF: Coupons & Promo Codes24 fevereiro 2025 -

s sale of Gumtree could increase online marketplace fees, says watchdog24 fevereiro 2025

-

Christmas Cashback Discounts, Offers & Deals24 fevereiro 2025

Christmas Cashback Discounts, Offers & Deals24 fevereiro 2025 -

UK Trying To Lure Displaced Poshmark Sellers24 fevereiro 2025

UK Trying To Lure Displaced Poshmark Sellers24 fevereiro 2025 -

.png) Bulk Edit Listing Tools24 fevereiro 2025

Bulk Edit Listing Tools24 fevereiro 2025

você pode gostar

-

Top 90 Personagens Mais Fortes do Anime Inuyasha24 fevereiro 2025

Top 90 Personagens Mais Fortes do Anime Inuyasha24 fevereiro 2025 -

Project Playtime - Play Now24 fevereiro 2025

Project Playtime - Play Now24 fevereiro 2025 -

Page 233 TheXboxHub24 fevereiro 2025

Page 233 TheXboxHub24 fevereiro 2025 -

Aliexpress é confiável para placa de vídeo? - Recomendações de serviços e lojas - Clube do Hardware24 fevereiro 2025

Aliexpress é confiável para placa de vídeo? - Recomendações de serviços e lojas - Clube do Hardware24 fevereiro 2025 -

Aprenda a fazer batata frita sequinha e crocante como um profissional - CenárioMT24 fevereiro 2025

Aprenda a fazer batata frita sequinha e crocante como um profissional - CenárioMT24 fevereiro 2025 -

How to Fish (with Pictures) - wikiHow24 fevereiro 2025

How to Fish (with Pictures) - wikiHow24 fevereiro 2025 -

Bruno Amaral: Alyson Court Dubladora ( Canadense ) Estrangeira24 fevereiro 2025

Bruno Amaral: Alyson Court Dubladora ( Canadense ) Estrangeira24 fevereiro 2025 -

A Review of Sailor Moon Crystal Season 3 (It ain't pretty24 fevereiro 2025

A Review of Sailor Moon Crystal Season 3 (It ain't pretty24 fevereiro 2025 -

sonic the hedgehog as batman, promotional render24 fevereiro 2025

sonic the hedgehog as batman, promotional render24 fevereiro 2025 -

Here's every playable character in Marvel's Midnight Suns - My Nintendo News24 fevereiro 2025

Here's every playable character in Marvel's Midnight Suns - My Nintendo News24 fevereiro 2025