What is a K-1 Trust Distribution? - CPA Firm, Accounting & Taxes

Por um escritor misterioso

Last updated 16 junho 2024

Selecting the Correct IRS Form 1099-R Box 7 Distribution Codes — Ascensus

Charitable Remainder Trusts (CRTs) - Wealthspire

Time to Act on These End-of-Year Tax Planning Tips

Income Tax Accounting for Trusts and Estates

Income Tax Accounting for Trusts and Estates

Don't Jeopardize Your S Corporation Status

Reporting foreign trust and estate distributions to U.S. beneficiaries: Part 3

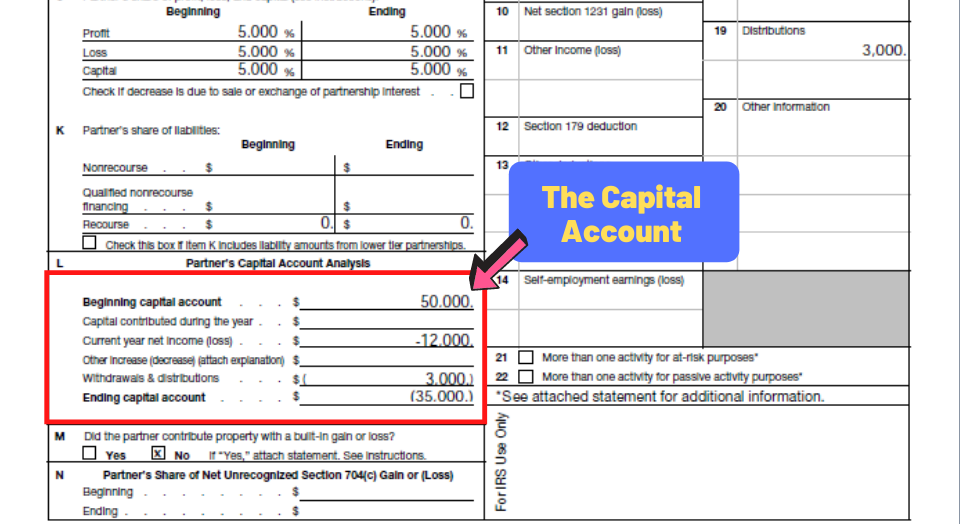

How To Read Schedule K-1?

What is a K-1 Trust Distribution? - CPA Firm, Accounting & Taxes

Avoid a Tax Nightmare with your Trust - Texas Trust Law

Tax Implications of Trust and Estate Distributions

:max_bytes(150000):strip_icc()/Form1065-55a61388dd91421d8736a94d3b20f03e.jpg)

Form 1065: U.S. Return of Partnership Income: Definition and How to File

How Are Trusts Taxed? FAQs - Wealthspire

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate Explained

Recomendado para você

-

Design de logotipo de carta sss com forma de círculo. design de16 junho 2024

Design de logotipo de carta sss com forma de círculo. design de16 junho 2024 -

SSS Team - ATTENTION: ALL SSS PENSIONERS WHO ARE NOT RECEIVING16 junho 2024

-

SSS16 junho 2024

SSS16 junho 2024 -

File:Jingle-Bells-Sheet-Music-chorus-SS.jpg - Wikipedia16 junho 2024

File:Jingle-Bells-Sheet-Music-chorus-SS.jpg - Wikipedia16 junho 2024 -

MIL-S-8660 - DOW CORNING16 junho 2024

MIL-S-8660 - DOW CORNING16 junho 2024 -

Home - Fort Valley State University16 junho 2024

Home - Fort Valley State University16 junho 2024 -

As Seen On TV Copper Fit, Back, S/M16 junho 2024

As Seen On TV Copper Fit, Back, S/M16 junho 2024 -

SS Badger Semi Truck & Oversized Load Ferry Rates & Info16 junho 2024

-

SSS amends guidelines on temporary ACOP suspension - PTV News16 junho 2024

SSS amends guidelines on temporary ACOP suspension - PTV News16 junho 2024 -

S·O·S™ Vitaflo™16 junho 2024

S·O·S™ Vitaflo™16 junho 2024

você pode gostar

-

Carro Chevrolet Corsa Classic para GTA IV16 junho 2024

Carro Chevrolet Corsa Classic para GTA IV16 junho 2024 -

PRO EVOLUTION SOCCER 2018 LITE Steam Charts & Stats16 junho 2024

PRO EVOLUTION SOCCER 2018 LITE Steam Charts & Stats16 junho 2024 -

Forza Horizon 5 Fast X Car Pack on Steam16 junho 2024

Forza Horizon 5 Fast X Car Pack on Steam16 junho 2024 -

DOCE DE FIGO / GELEIA DE FIGO CASEIRA FEITA NA ROÇA #15316 junho 2024

DOCE DE FIGO / GELEIA DE FIGO CASEIRA FEITA NA ROÇA #15316 junho 2024 -

Pokemon Legends Arceus - PC Gameplay - Emulated - DODI Releases16 junho 2024

Pokemon Legends Arceus - PC Gameplay - Emulated - DODI Releases16 junho 2024 -

YOSHIO HIRAMINE PRESIDENTE DA FPEX, REVELA DETALHES DO 89º16 junho 2024

YOSHIO HIRAMINE PRESIDENTE DA FPEX, REVELA DETALHES DO 89º16 junho 2024 -

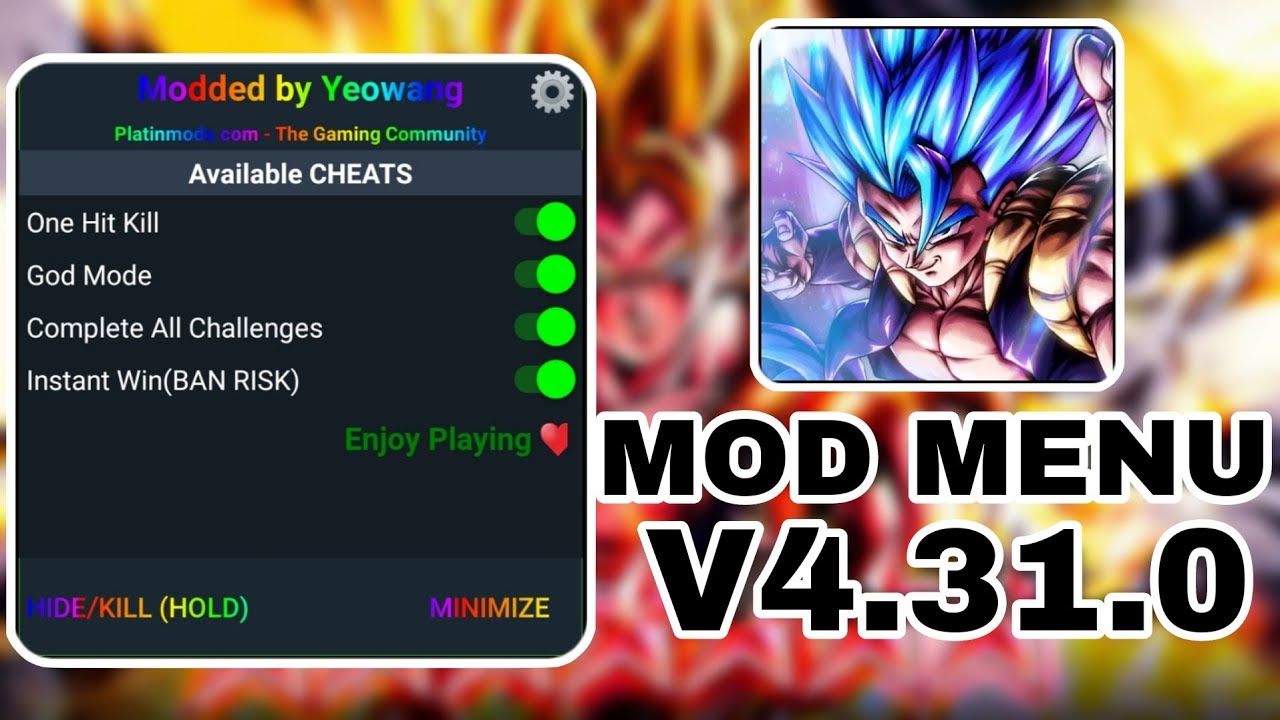

Dragon Ball Legends Ultra Mod Menu v4.31.016 junho 2024

Dragon Ball Legends Ultra Mod Menu v4.31.016 junho 2024 -

Mattaku Saikin no Tantei to Kitara : r/manga](https://i.redd.it/1rphhbqik2y91.jpg) SL](Request) Mattaku Saikin no Tantei to Kitara : r/manga16 junho 2024

SL](Request) Mattaku Saikin no Tantei to Kitara : r/manga16 junho 2024 -

Valorant Pearl map release date, teasers, and more16 junho 2024

Valorant Pearl map release date, teasers, and more16 junho 2024 -

Accurate Rainbow Friends Roleplay16 junho 2024