Itemize - Home

Por um escritor misterioso

Last updated 02 março 2025

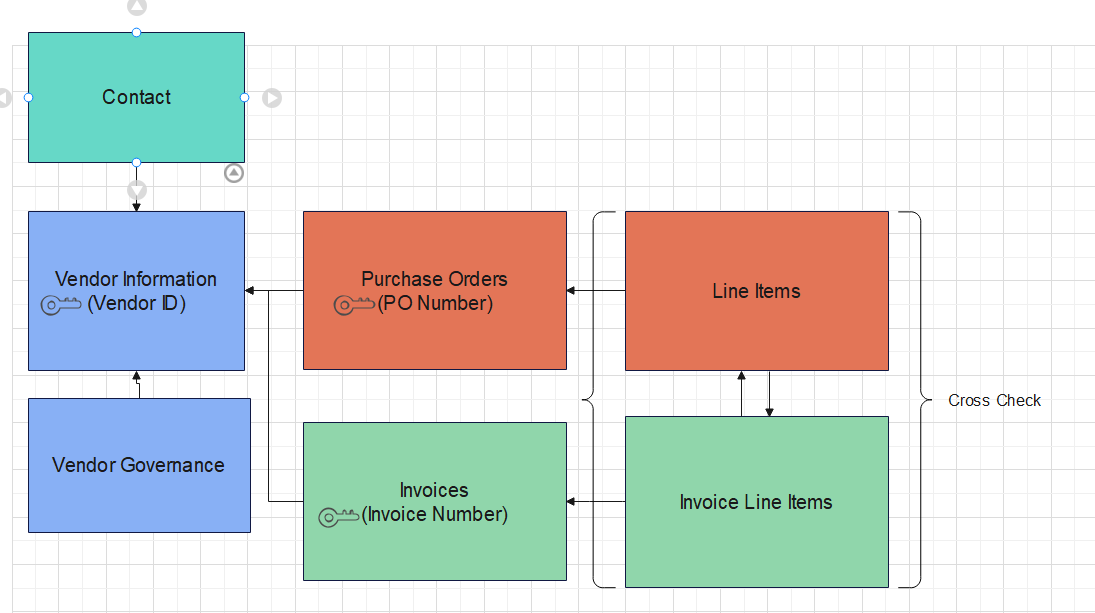

Itemize automates B2B financial document processing, enhances risk assessment, and helps approve transactions via streamlined information flows and improved business intelligence.

Can you deduct home office expenses? - Vero Beach FL Accountant

Is New Flooring Tax Deductible?

Understanding the Mortgage Interest Deduction With TaxSlayer

Do You Itemize or Take the Standard Deduction - The Tech Savvy CPA

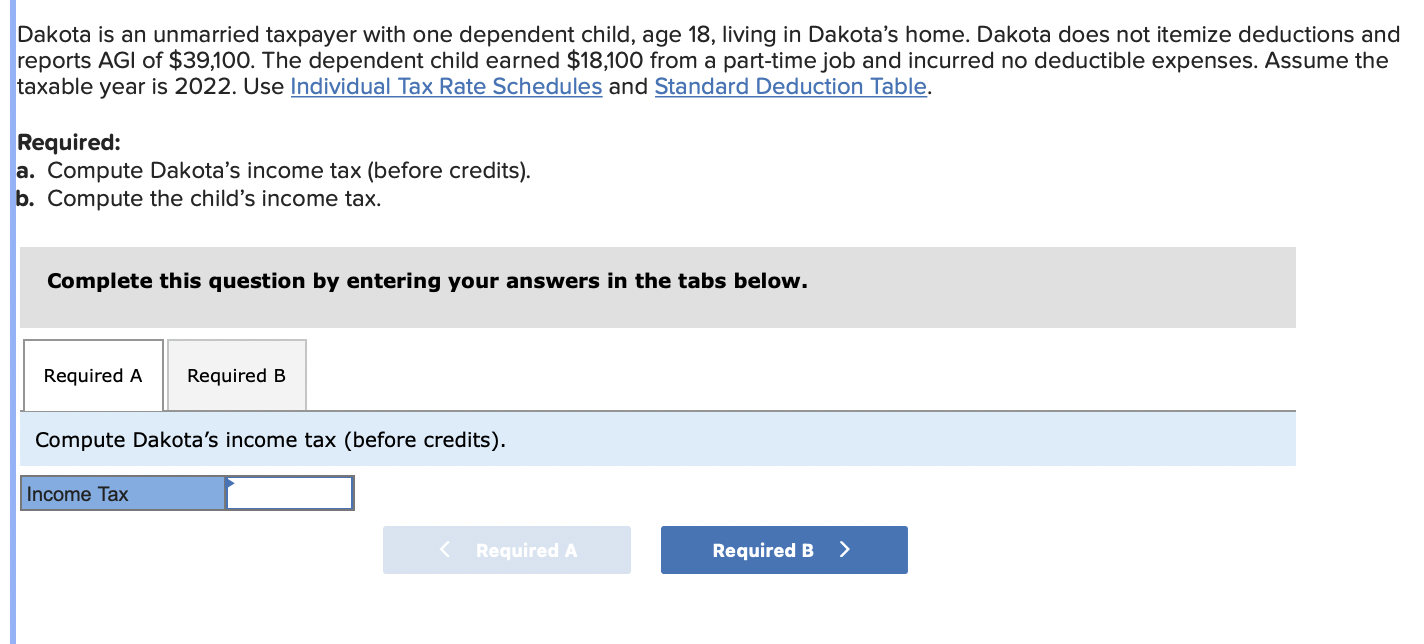

Solved Dakota is an unmarried taxpayer with one dependent

Homeowners & New Limit on SALT Deductions - SKJ&T

Standard Deduction vs. Itemized Deductions: Which Is Better? - TurboTax Tax Tips & Videos

Get a Tax Credit for Buying a House

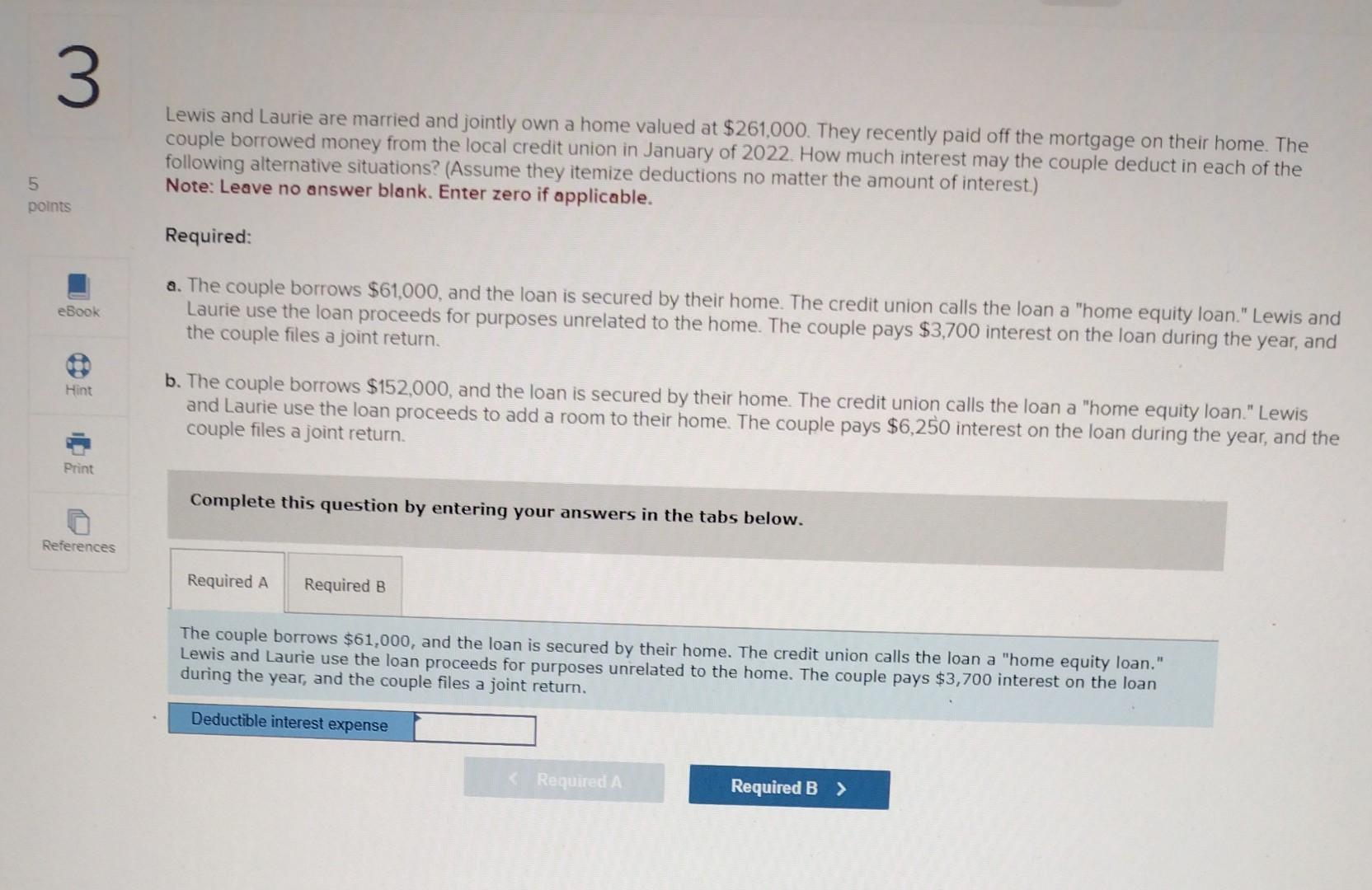

Solved Lewis and Laurie are married and jointly own a home

Simplified Home Office Deduction: When Does It Benefit Taxpayers?

Working from home amid coronavirus? What it may mean for filing your taxes.

Is Buying A Home A Good Investment?

:strip_icc()/woman-spreads-drop-cloth-home-improvement-a499aa3306b34d8293b870d919301405.jpg)

4 Home Improvement Projects that Are Potentially Tax-Deductible

Recomendado para você

-

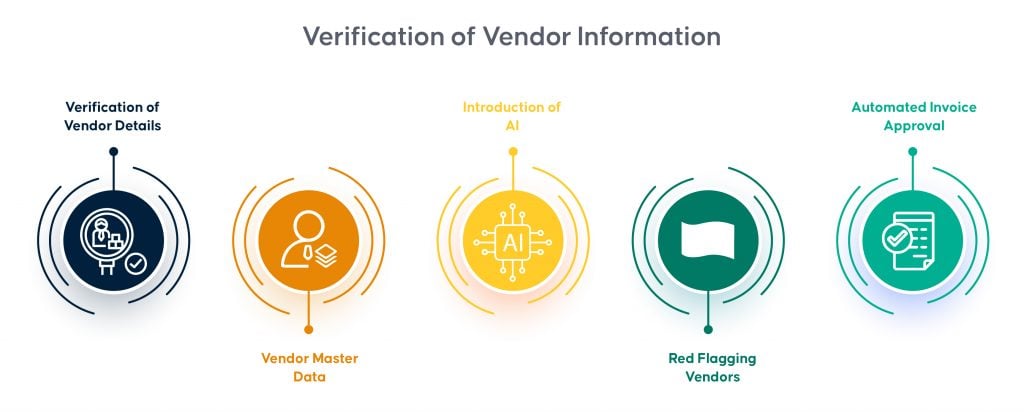

How to Verify an Invoice? Invoice Checking Process02 março 2025

How to Verify an Invoice? Invoice Checking Process02 março 2025 -

How do Companies use AI to Check Duplicate Invoices?02 março 2025

How do Companies use AI to Check Duplicate Invoices?02 março 2025 -

3-Way Match and Accounts Payable • MHC02 março 2025

3-Way Match and Accounts Payable • MHC02 março 2025 -

Invoice Number — What You Need to Know02 março 2025

Invoice Number — What You Need to Know02 março 2025 -

Generate Credit Note Against Invoice Online02 março 2025

-

Cabilock Cross Reciepts Memo Holder Bill Stick Restaurant Supplies Paper Holder Bill Organizer Invoice Spike Work Desk Paper Stand Check Spike Bills02 março 2025

Cabilock Cross Reciepts Memo Holder Bill Stick Restaurant Supplies Paper Holder Bill Organizer Invoice Spike Work Desk Paper Stand Check Spike Bills02 março 2025 -

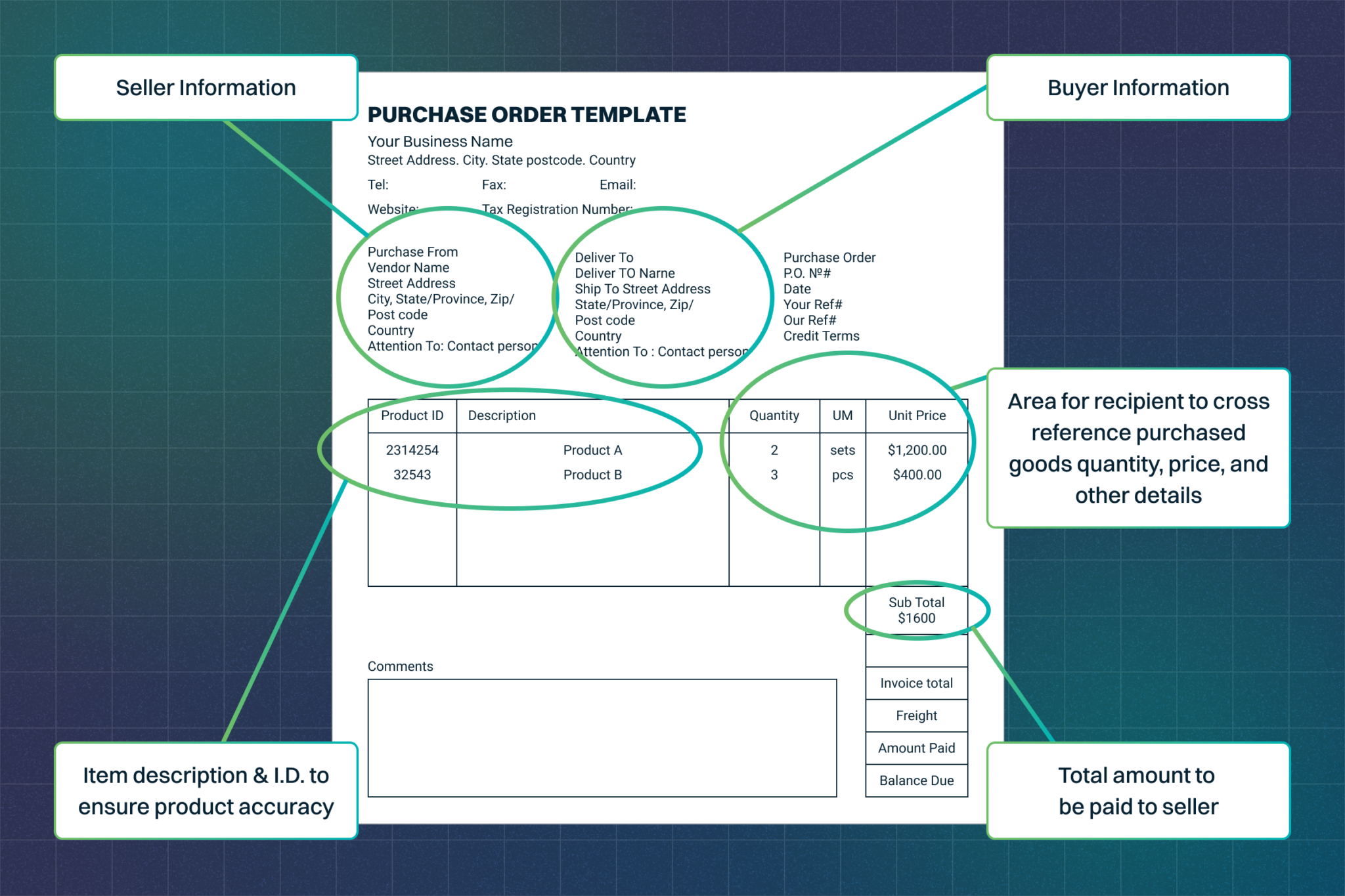

Know the difference: POs, packing slips, & invoices - Linnworks02 março 2025

Know the difference: POs, packing slips, & invoices - Linnworks02 março 2025 -

Solved: Drill Down on list and AD User Access - Power Platform Community02 março 2025

-

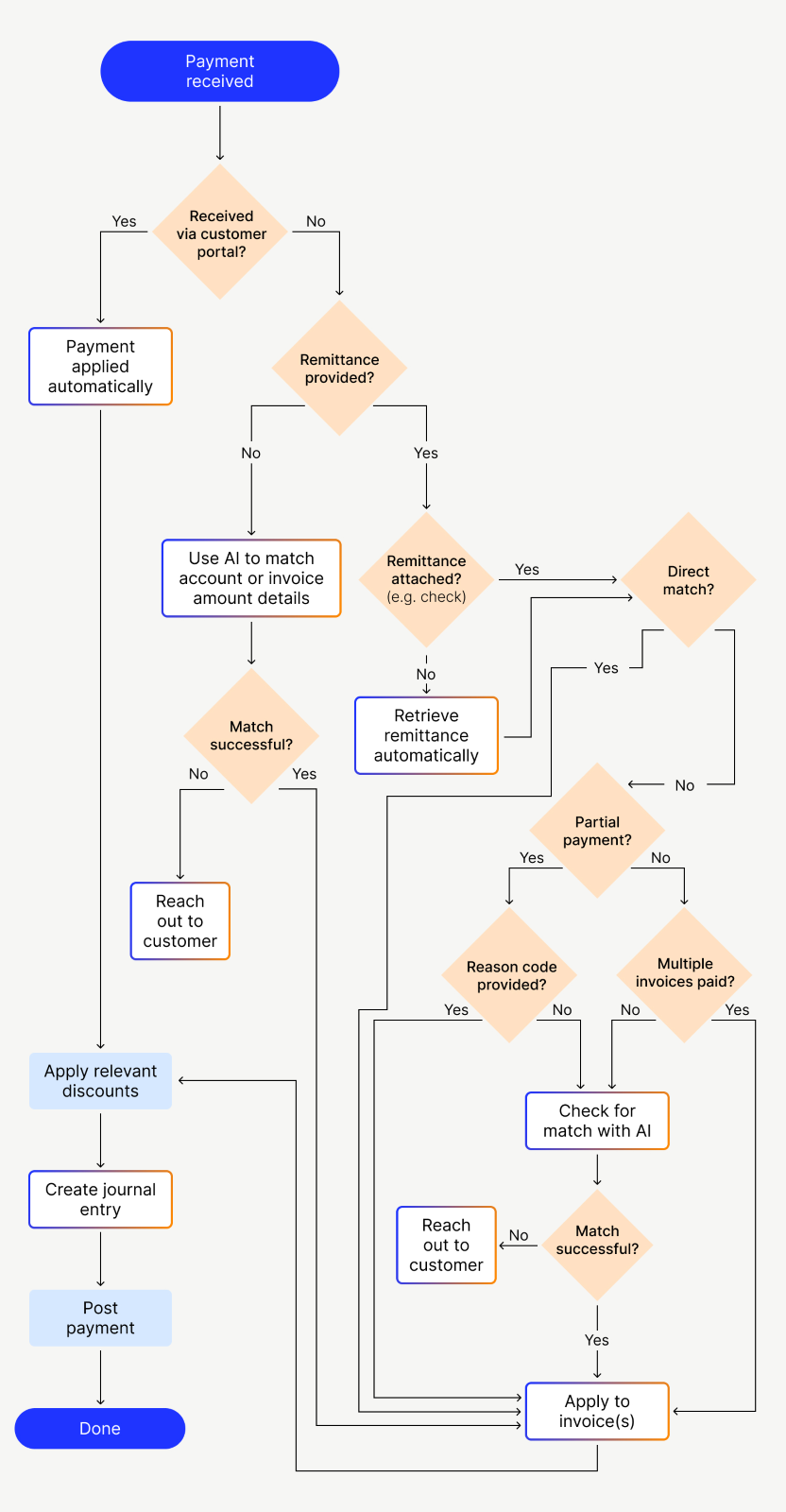

Accounts Receivable Process Flow Chart Guide02 março 2025

Accounts Receivable Process Flow Chart Guide02 março 2025 -

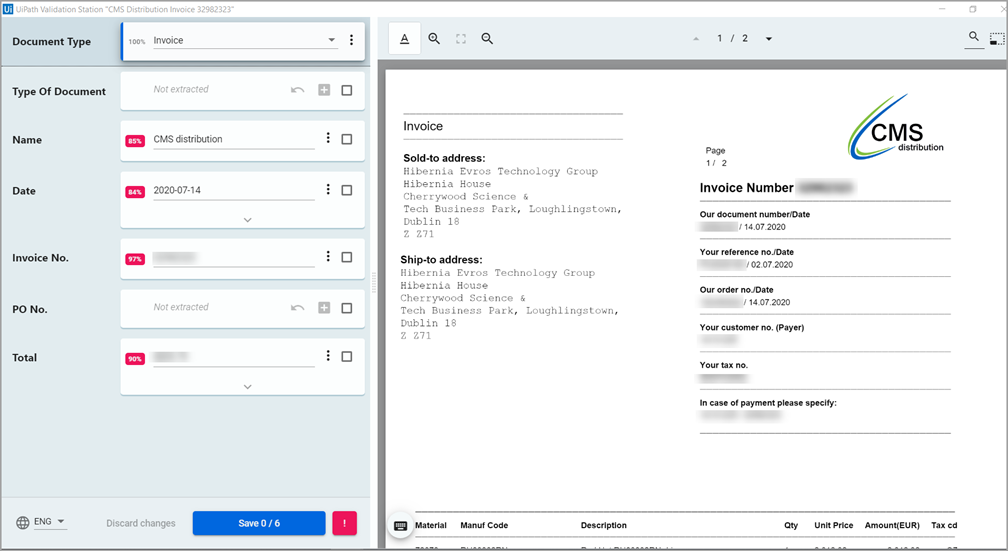

RPA Case Study in IT Services - Evros Technology Group02 março 2025

RPA Case Study in IT Services - Evros Technology Group02 março 2025

você pode gostar

-

Afinal, como Dragon Ball Super pode explorar o seu multiverso02 março 2025

Afinal, como Dragon Ball Super pode explorar o seu multiverso02 março 2025 -

Articulated Boom 45' - E450AJ - Rental02 março 2025

Articulated Boom 45' - E450AJ - Rental02 março 2025 -

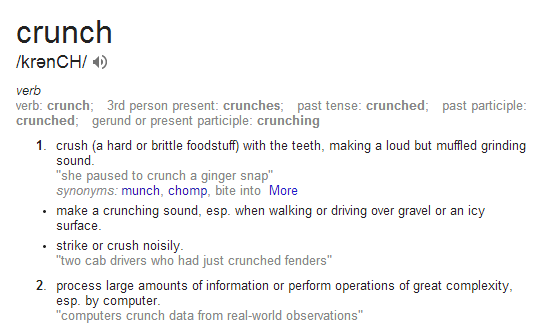

Google Search Gets Improved Dictionary Definitions With Sample02 março 2025

Google Search Gets Improved Dictionary Definitions With Sample02 março 2025 -

Luke Skywalker (Mark Hamill) em Star Wars: Os Últimos Jedi – Action Figure Perfeita 1:6 Hot Toys « Blog de Brinquedo02 março 2025

Luke Skywalker (Mark Hamill) em Star Wars: Os Últimos Jedi – Action Figure Perfeita 1:6 Hot Toys « Blog de Brinquedo02 março 2025 -

![🎃Halloween🎃]Anime Ninja War Tycoon codes: Free Diamonds, Chi](https://external-preview.redd.it/wSLusHbkiB9rGC3RdlrBydwcHND9phjtcZy_fm9D2B0.jpg?auto=webp&s=fe8c195b565a5c5307c9e70e5b2688fecf9f38a3) 🎃Halloween🎃]Anime Ninja War Tycoon codes: Free Diamonds, Chi02 março 2025

🎃Halloween🎃]Anime Ninja War Tycoon codes: Free Diamonds, Chi02 março 2025 -

Demon Sonic EXE on X: Feel Free To Dm Me Anytime / X02 março 2025

Demon Sonic EXE on X: Feel Free To Dm Me Anytime / X02 março 2025 -

Fanfics de Kamigami no Asobi - Spirit Fanfics e Histórias02 março 2025

Fanfics de Kamigami no Asobi - Spirit Fanfics e Histórias02 março 2025 -

Barbie filme princesa xadrez impresso vestido, Roupa infantil de Halloween, Vestido de meninas, 202302 março 2025

Barbie filme princesa xadrez impresso vestido, Roupa infantil de Halloween, Vestido de meninas, 202302 março 2025 -

Replying to @deathoncrax #fyp #pokemonbrickbronze #pokemon #roblox #br02 março 2025

-

Domestic Girlfriend Volume 18 (Domestic na Kanojo) - Manga Store02 março 2025

Domestic Girlfriend Volume 18 (Domestic na Kanojo) - Manga Store02 março 2025