What Is Social Security Tax? Definition, Exemptions, and Example

Por um escritor misterioso

Last updated 28 fevereiro 2025

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

The Social Security tax, levied on both employers and employees, funds Social Security and is collected in the form of a payroll tax or a self-employment tax.

Program Explainer: Windfall Elimination Provision

Tax on Social Security Benefits – Social Security Intelligence

What is a payroll tax?, Payroll tax definition, types, and employer obligations

7 Things to Know About Social Security and Taxes

FICA Tax: What It is and How to Calculate It

What are the major federal payroll taxes, and how much money do they raise?

10 Ways to Be Tax Exempt

Income Definitions for Marketplace and Medicaid Coverage - Beyond the Basics

What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status - Foundation Group®

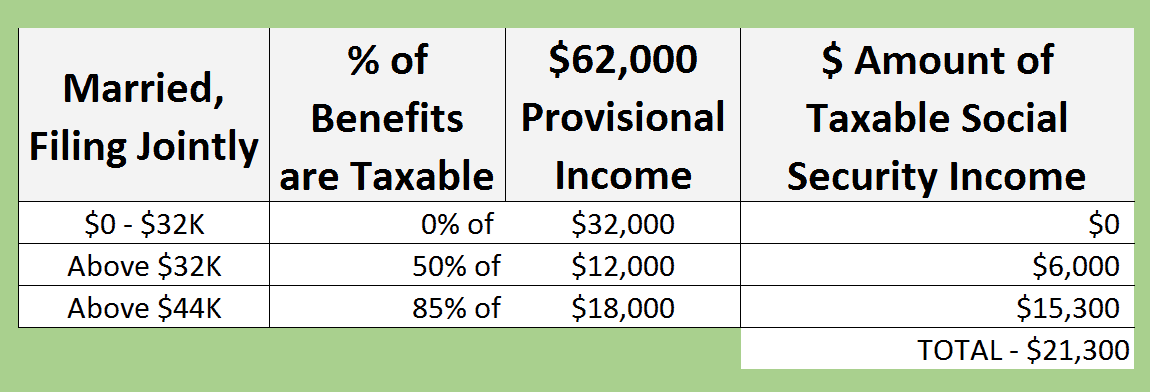

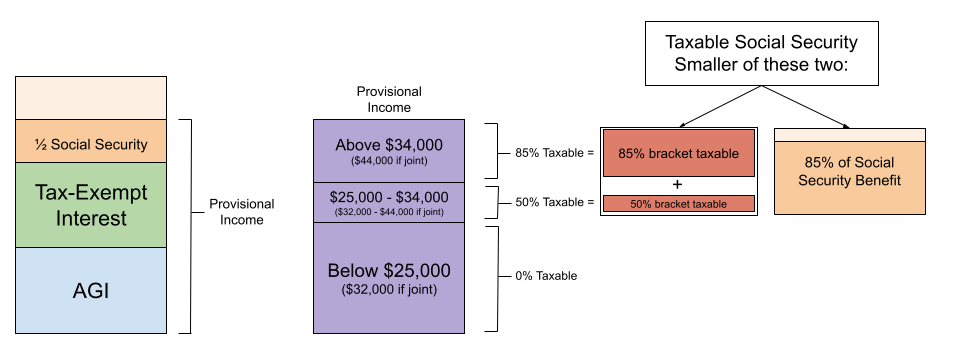

Federal Taxation of Social Security Benefits

Recomendado para você

-

What is FICA28 fevereiro 2025

What is FICA28 fevereiro 2025 -

What are FICA Taxes? 2022-2023 Rates and Instructions28 fevereiro 2025

-

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks28 fevereiro 2025

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks28 fevereiro 2025 -

FICA Tax: 4 Steps to Calculating FICA Tax in 202328 fevereiro 2025

FICA Tax: 4 Steps to Calculating FICA Tax in 202328 fevereiro 2025 -

What is the FICA Tax and How Does it Connect to Social Security?28 fevereiro 2025

-

What is the FICA Tax Refund?28 fevereiro 2025

What is the FICA Tax Refund?28 fevereiro 2025 -

Do You Have To Pay Tax On Your Social Security Benefits?28 fevereiro 2025

Do You Have To Pay Tax On Your Social Security Benefits?28 fevereiro 2025 -

What Are FICA Taxes And Do They Affect Me?, by M. De Oto28 fevereiro 2025

What Are FICA Taxes And Do They Affect Me?, by M. De Oto28 fevereiro 2025 -

What Is FICA Tax? —28 fevereiro 2025

What Is FICA Tax? —28 fevereiro 2025 -

What Eliminating FICA Tax Means for Your Retirement28 fevereiro 2025

você pode gostar

-

PIA Senpai's Top Seasons: Seishun Buta Yarou wa Bunny Girl Senpai28 fevereiro 2025

PIA Senpai's Top Seasons: Seishun Buta Yarou wa Bunny Girl Senpai28 fevereiro 2025 -

Five Nights at Freddy's Glitchtrap Curse Of Dreadbear Action28 fevereiro 2025

Five Nights at Freddy's Glitchtrap Curse Of Dreadbear Action28 fevereiro 2025 -

Como saber qual SSD é compatível com meu notebook – Tecnoblog28 fevereiro 2025

Como saber qual SSD é compatível com meu notebook – Tecnoblog28 fevereiro 2025 -

Alura no LinkedIn: Imersão Dev: Aprenda a Programar de graça em28 fevereiro 2025

-

Gakusen Toshi Asterisk - Gakusen Toshi Asterisk Episode 5 is now available on Crunchyroll!28 fevereiro 2025

-

Funtime Freddy, Five Nights at Freddy's Wiki28 fevereiro 2025

Funtime Freddy, Five Nights at Freddy's Wiki28 fevereiro 2025 -

Garota Desenho Animado PNG , Boneca, Desenho Animado, Pessoas PNG Imagem para download gratuito28 fevereiro 2025

Garota Desenho Animado PNG , Boneca, Desenho Animado, Pessoas PNG Imagem para download gratuito28 fevereiro 2025 -

Template Transparent R15 04112017 - Roblox Pants Template 2017 PNG Image With Transparent Background png - Free PNG Images28 fevereiro 2025

Template Transparent R15 04112017 - Roblox Pants Template 2017 PNG Image With Transparent Background png - Free PNG Images28 fevereiro 2025 -

Replying to @Joel Pinto Real ones remember this from BACK IN THE28 fevereiro 2025

-

Drift: Car Drifting Race Free Game::Appstore for Android28 fevereiro 2025

Drift: Car Drifting Race Free Game::Appstore for Android28 fevereiro 2025