Brazil Lending Rate: per Annum: Pre-Fixed: Corporate Entities: Vendor: Banco Cedula S.A., Economic Indicators

Por um escritor misterioso

Last updated 27 dezembro 2024

Brazil Lending Rate: per Annum: Pre-Fixed: Corporate Entities: Vendor: Banco Cedula S.A. data was reported at 0.000 % pa in Jul 2019. This stayed constant from the previous number of 0.000 % pa for Jul 2019. Brazil Lending Rate: per Annum: Pre-Fixed: Corporate Entities: Vendor: Banco Cedula S.A. data is updated daily, averaging 0.000 % pa from Jan 2012 to 03 Jul 2019, with 1865 observations. The data reached an all-time high of 14.290 % pa in 27 Apr 2013 and a record low of 0.000 % pa in 03 Jul 2019. Brazil Lending Rate: per Annum: Pre-Fixed: Corporate Entities: Vendor: Banco Cedula S.A. data remains active status in CEIC and is reported by Central Bank of Brazil. The data is categorized under Brazil Premium Database’s Interest and Foreign Exchange Rates – Table BR.MB045: Lending Rate: per Annum: by Banks: Pre-Fixed: Corporate Entities: Vendor. Lending Rate: Daily: Interest rates disclosed represent the total cost of the transaction to the client, also including taxes and operating. These rates correspond to the average fees in the period indicated in the tables. There are presented only institutions that had granted during the period determined. In general, institutions practicing different rates within the same type of credit. Thus, the rate charged to a customer may differ from the average. Several factors such as the time and volume of the transaction, as well as the guarantees offered, explain the differences between interest rates. Certain institutions grant allowance of the use of the term overdraft. However, this is not considered in the calculation of rates of this type. It should be noted that the overdraft is a modality that has high interest rates. Thus, its use should be restricted to short periods. If the customer needs resources for a longer period, should find ways to offer lower rates. The Brazilian Central Bank publishes these data with a delay about 20 days with relation to the reference period, thus allowing sufficient time for all Financial Institutions to deliver the relevant information. Interest rates presented in this set of tables correspond to averages weighted by the values of transactions conducted in the five working days specified in each table. These rates represent the average effective cost of loans to customers, consisting of the interest rates actually charged by financial institutions in their lending operations, increased tax burdens and operational incidents on the operations. The interest rates shown are the average of the rates charged in the various operations performed by financial institutions, in each modality. In one discipline, interest rates may differ between customers of the same financial institution. Interest rates vary according to several factors, such as the value and quality of collateral provided in the operation, the proportion of down payment operation, the history and the registration status of each client, the term of the transaction, among others . Institutions with “zero” did not operate on modalities for those periods or did not provide information to the Central Bank of Brazil. The Central Bank of Brazil assumes no responsibility for delay, error or other deficiency of information provided for purposes of calculating average rates presented in this

Brazil Lending Rate: per Annum: Pre-Fixed: Corporate Entities

Native Traditions in The Postconquest World, PDF

Converted file

SEC Filing - Fusion Fuel

Brazil's High Interest Rates Sparks Rush Into Corporate Bonds

PDF) The World Bank's 'Market Assisted Land Reform' in Colombia

Brazil, Lending Rate: Central Bank of Brazil

Peru: Third Review Under the Stand-By Arrangement and Request for

Brazil Real Forecast Will The Brazil Real Get Stronger?

StoneCo Ltd. - SEC Filing

Itau Unibanco Holding S.A. Form 6-K Current Report Filed 2023-11-22

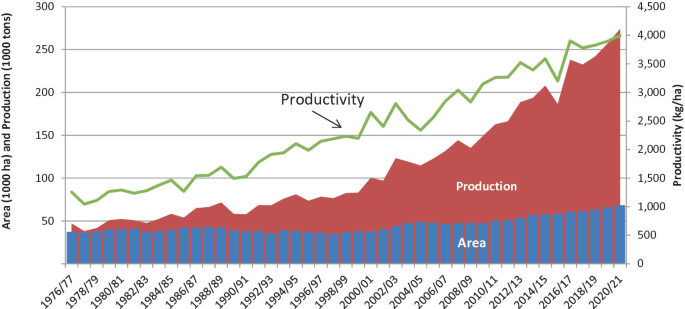

The Modernization of Brazilian Agriculture Since 1950

Brazil: Stock Markets and Corporate Credit Now Driving

Chapter 5. The Role of Fiscal Policies in Peru's Transformation in

Recomendado para você

-

File:Caruana, Jaime (IMF 2008) (frame).jpg - Wikimedia Commons27 dezembro 2024

File:Caruana, Jaime (IMF 2008) (frame).jpg - Wikimedia Commons27 dezembro 2024 -

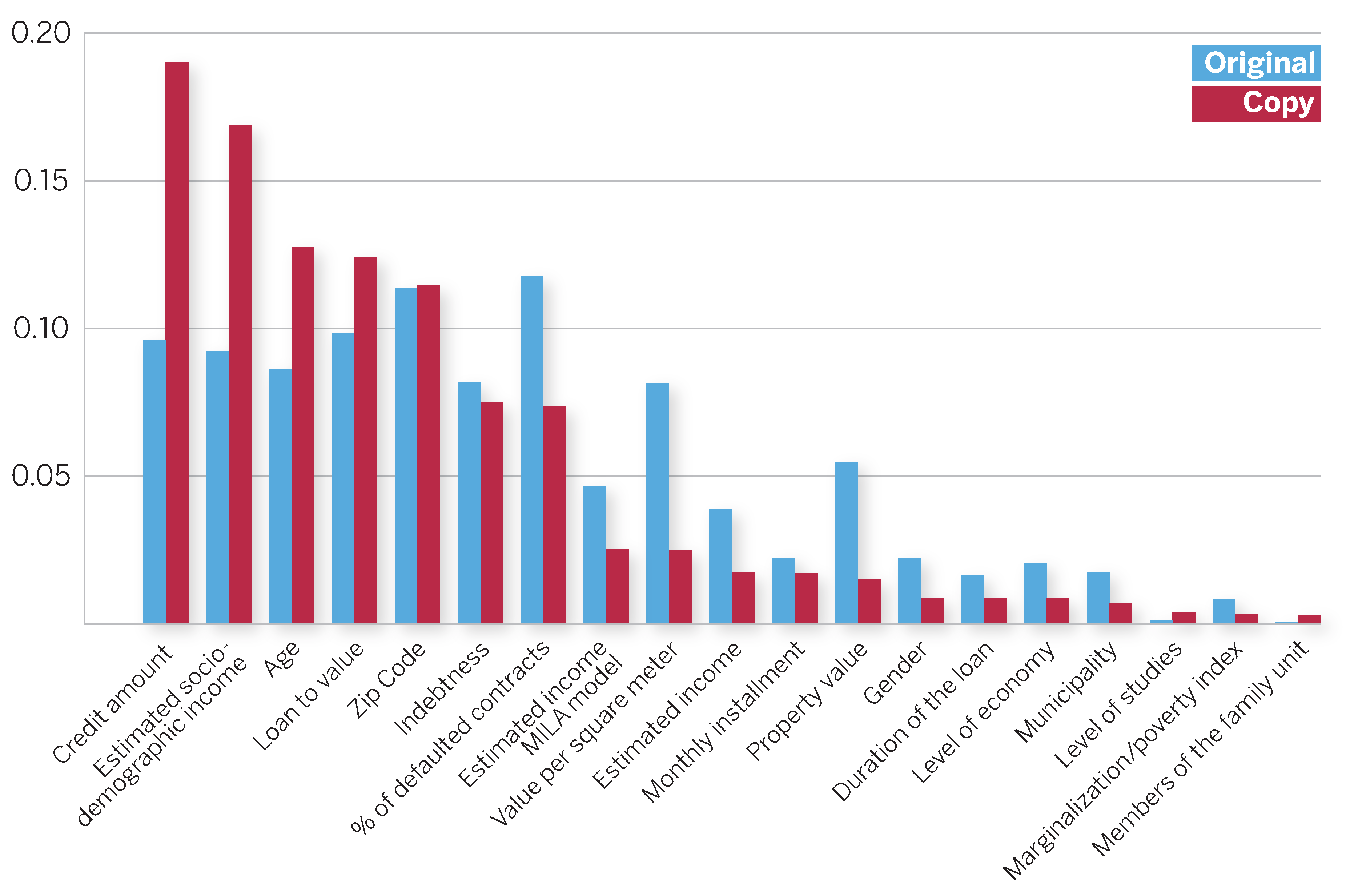

Entropy, Free Full-Text27 dezembro 2024

Entropy, Free Full-Text27 dezembro 2024 -

Resumen - Universidad de Navarra27 dezembro 2024

Resumen - Universidad de Navarra27 dezembro 2024 -

Flashback pluggable database no Data Guard27 dezembro 2024

Flashback pluggable database no Data Guard27 dezembro 2024 -

Full article: The impact of credit shocks on the European labour market27 dezembro 2024

-

The perennial challenge to counter Too-Big-to-Fail in banking: Empirical evidence from the new international regulation dealing with Global Systemically Important Banks - ScienceDirect27 dezembro 2024

The perennial challenge to counter Too-Big-to-Fail in banking: Empirical evidence from the new international regulation dealing with Global Systemically Important Banks - ScienceDirect27 dezembro 2024 -

PDF) International financial markets and bank funding in the euro area: dynamics and participants27 dezembro 2024

PDF) International financial markets and bank funding in the euro area: dynamics and participants27 dezembro 2024 -

Government Gazette No. 18105 - doi photography competition27 dezembro 2024

Government Gazette No. 18105 - doi photography competition27 dezembro 2024 -

Calibration alternatives to logistic regression and their potential for transferring the statistical dispersion of discriminatory power into uncertainties in probabilities of default - Journal of Credit Risk27 dezembro 2024

Calibration alternatives to logistic regression and their potential for transferring the statistical dispersion of discriminatory power into uncertainties in probabilities of default - Journal of Credit Risk27 dezembro 2024 -

Macroprudential policy and instruments: Setting counter-cyclical capital buffers in converging economies Jan Frait Executive Director Financial Stability. - ppt download27 dezembro 2024

Macroprudential policy and instruments: Setting counter-cyclical capital buffers in converging economies Jan Frait Executive Director Financial Stability. - ppt download27 dezembro 2024

você pode gostar

-

How many episodes does Dragon Ball have? - Quora27 dezembro 2024

-

Meguru Bachira, Heroes Wiki27 dezembro 2024

Meguru Bachira, Heroes Wiki27 dezembro 2024 -

Subway Surfers on X: #ShopUpdate ⭐ The clock is ticking! Unlock27 dezembro 2024

Subway Surfers on X: #ShopUpdate ⭐ The clock is ticking! Unlock27 dezembro 2024 -

Boneca Bebê Reborn Vinil Realista com Pelúcia e acessórios 45cm - Barra Rey27 dezembro 2024

Boneca Bebê Reborn Vinil Realista com Pelúcia e acessórios 45cm - Barra Rey27 dezembro 2024 -

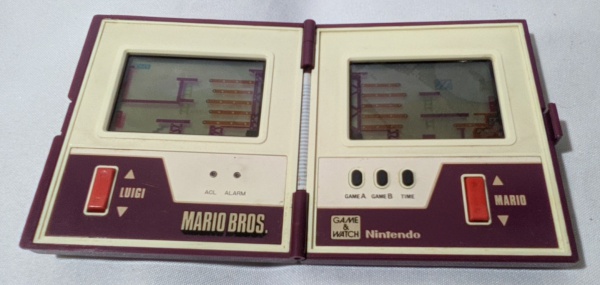

Mini Game Mario Bros Multiscreen. Fabricante: Nintendo.27 dezembro 2024

Mini Game Mario Bros Multiscreen. Fabricante: Nintendo.27 dezembro 2024 -

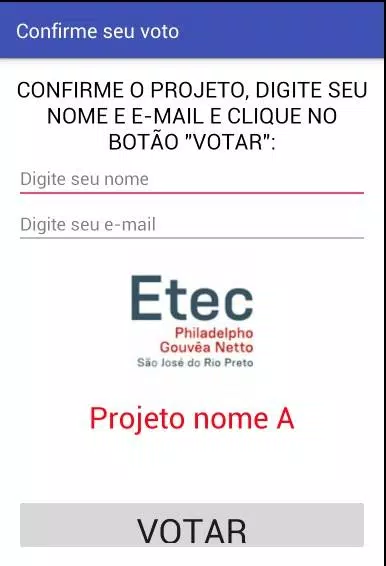

Download do APK de Votação Mostra Técnica da Etec Philadelpho 201827 dezembro 2024

Download do APK de Votação Mostra Técnica da Etec Philadelpho 201827 dezembro 2024 -

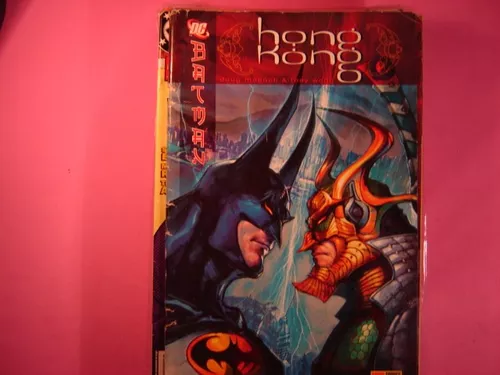

Cx B 34 Mangá Hq Coleção Dc Gibi Batman Hong Kong27 dezembro 2024

Cx B 34 Mangá Hq Coleção Dc Gibi Batman Hong Kong27 dezembro 2024 -

Conta feminina fofa de roblox com - Roblox - Outros jogos Roblox27 dezembro 2024

Conta feminina fofa de roblox com - Roblox - Outros jogos Roblox27 dezembro 2024 -

gabimaru #gabimaruthehollow #gabimaruedit #gabimaruhellsparadise #gab, Gabimaru27 dezembro 2024

-

Fillers em Naruto Shippuden: saiba todos os fillers do anime (e quais ver)!27 dezembro 2024

Fillers em Naruto Shippuden: saiba todos os fillers do anime (e quais ver)!27 dezembro 2024