CMBS and Commercial Real Estate Implications of a Kohl's Takeover

Por um escritor misterioso

Last updated 03 março 2025

Key Takeaways: Kohl’s plans to open smaller stores and transition away from department store formatThe highest concentration of Kohl’s lease expirations occurs in 2024 impacting $815 million in CMBS debtCMBS exposure to Kohl’s totals approximately $5 billion Speculation surrounding Kohl’s and its future as a public company has been active during Q1 2022. In early-March

CMBS Implications of Potential Kohl's Takeover – Commercial Observer

PETITION

2010 Global Market Report - NAI Commercial Real Estate

/cloudfront-us-east-2.images.arcpublishing.com/reuters/ZO6DFK5FHFPDFN6BTD3U2GJRYY.jpg)

Activist investor, takeover talk heap pressure on Kohl's Corp

Annual Real Estate Investment Report - Greater Boston by The Real Reporter - Issuu

Press Release Archives - Page 2 of 10 - Mission Capital

/cloudfront-us-east-2.images.arcpublishing.com/reuters/E4S4ZJKZ4ZMCNJOR7HRBCGWR4Y.jpg)

Activist investor, takeover talk heap pressure on Kohl's Corp

News Hamilton Pacific Real Estate Group, Inc.

Shorting Real Estate, REIT Investment

Press Release Archives - Page 2 of 10 - Mission Capital

Recomendado para você

-

New Kohl's to open in Katy this November, complete with an in-store Sephora03 março 2025

New Kohl's to open in Katy this November, complete with an in-store Sephora03 março 2025 -

Kohl's location in Forney scheduled for grand opening on Nov. 3, Business03 março 2025

Kohl's location in Forney scheduled for grand opening on Nov. 3, Business03 março 2025 -

Kohl's Gets $9 Billion Bid From Starboard Value Group - WSJ03 março 2025

-

Kohl's to close 18 underperforming stores – The Morning Call03 março 2025

Kohl's to close 18 underperforming stores – The Morning Call03 março 2025 -

Kohl's new D-FW store plans include center developed by Dallas Cowboys owner Jerry Jones03 março 2025

Kohl's new D-FW store plans include center developed by Dallas Cowboys owner Jerry Jones03 março 2025 -

Kohl's Makes a Major Change Its Customers Will Love (Target Won't) - TheStreet03 março 2025

Kohl's Makes a Major Change Its Customers Will Love (Target Won't) - TheStreet03 março 2025 -

Kohl's Rewards03 março 2025

-

Is Amarillo's Kohl's Any Closer to Opening Back Up?03 março 2025

Is Amarillo's Kohl's Any Closer to Opening Back Up?03 março 2025 -

Officials: Bomb threat made against Kentuckiana area Kohl's03 março 2025

Officials: Bomb threat made against Kentuckiana area Kohl's03 março 2025 -

Kohl's Will Shrink but Not Close Stores to Fend Off Declining03 março 2025

Kohl's Will Shrink but Not Close Stores to Fend Off Declining03 março 2025

você pode gostar

-

Roblox Rainbow Friends Baby Blue/green/yellow Pelúcia Toy Cute03 março 2025

Roblox Rainbow Friends Baby Blue/green/yellow Pelúcia Toy Cute03 março 2025 -

Triciclo de Passeio e Pedal para Bebe Calesita Moto Uno Rosa - Maçã Verde Baby03 março 2025

Triciclo de Passeio e Pedal para Bebe Calesita Moto Uno Rosa - Maçã Verde Baby03 março 2025 -

El triste momento que Barbara, de Stranger Things, enfrentó por03 março 2025

El triste momento que Barbara, de Stranger Things, enfrentó por03 março 2025 -

Mr. Jay (RB) – Bendy vs Tattletail Lyrics03 março 2025

Mr. Jay (RB) – Bendy vs Tattletail Lyrics03 março 2025 -

Jogo Novo Midia Fisica God of War 2 Greatest Hits para Ps2 - Sony03 março 2025

Jogo Novo Midia Fisica God of War 2 Greatest Hits para Ps2 - Sony03 março 2025 -

New HD Backgrounds - Wallpaper Cave03 março 2025

New HD Backgrounds - Wallpaper Cave03 março 2025 -

Subway Surfers Edinburgh 2020 Mod Apk 2.3.103 março 2025

Subway Surfers Edinburgh 2020 Mod Apk 2.3.103 março 2025 -

in time memorial. — Whether one should watch Cross Ange: Tenshi to03 março 2025

in time memorial. — Whether one should watch Cross Ange: Tenshi to03 março 2025 -

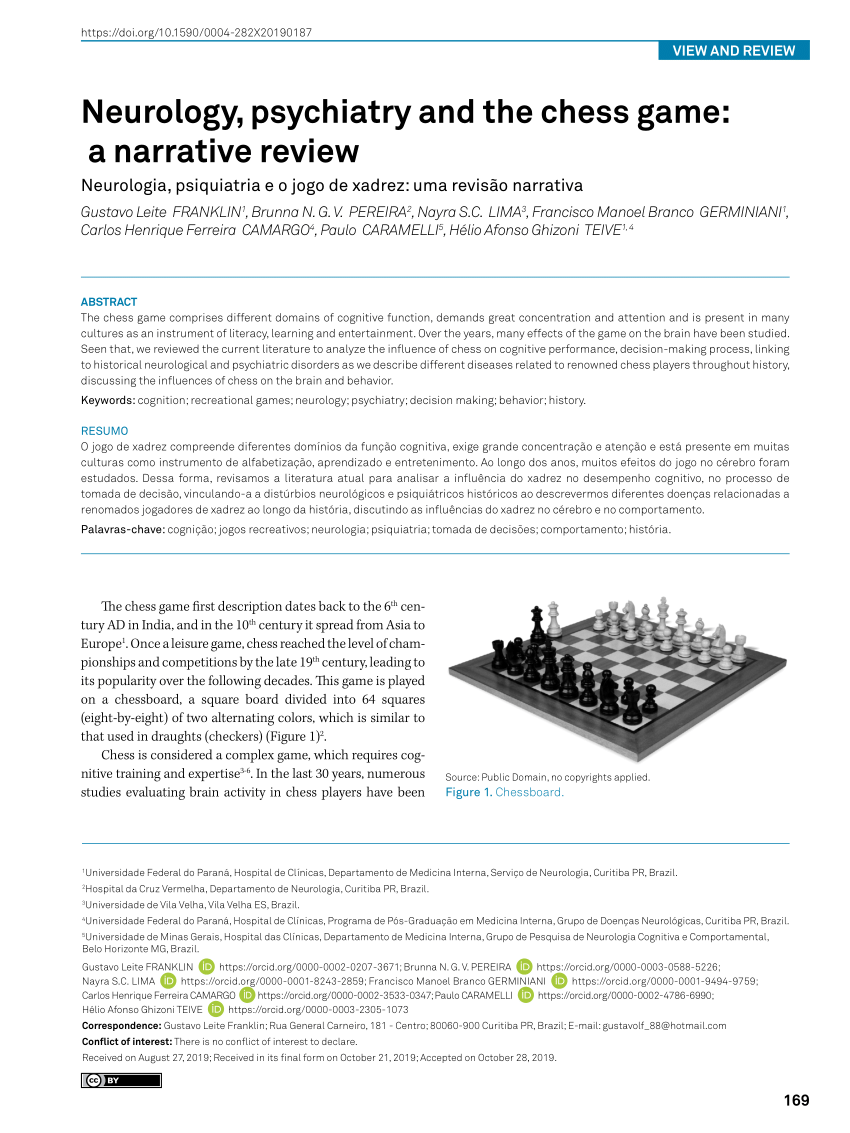

PDF) Reply Resposta “Neurology, psychiatry and the chess game”03 março 2025

PDF) Reply Resposta “Neurology, psychiatry and the chess game”03 março 2025 -

PARADISE DUNES (TOFO, MOÇAMBIQUE): 20 fotos, comparação de preços e avaliações - Tripadvisor03 março 2025

PARADISE DUNES (TOFO, MOÇAMBIQUE): 20 fotos, comparação de preços e avaliações - Tripadvisor03 março 2025