or Sale of $600 Now Prompt an IRS Form 1099-K

Por um escritor misterioso

Last updated 02 abril 2025

Starting in 2022, selling as little as $600 worth of stuff on a site like , or Facebook Marketplace, will prompt an IRS 1099-K.

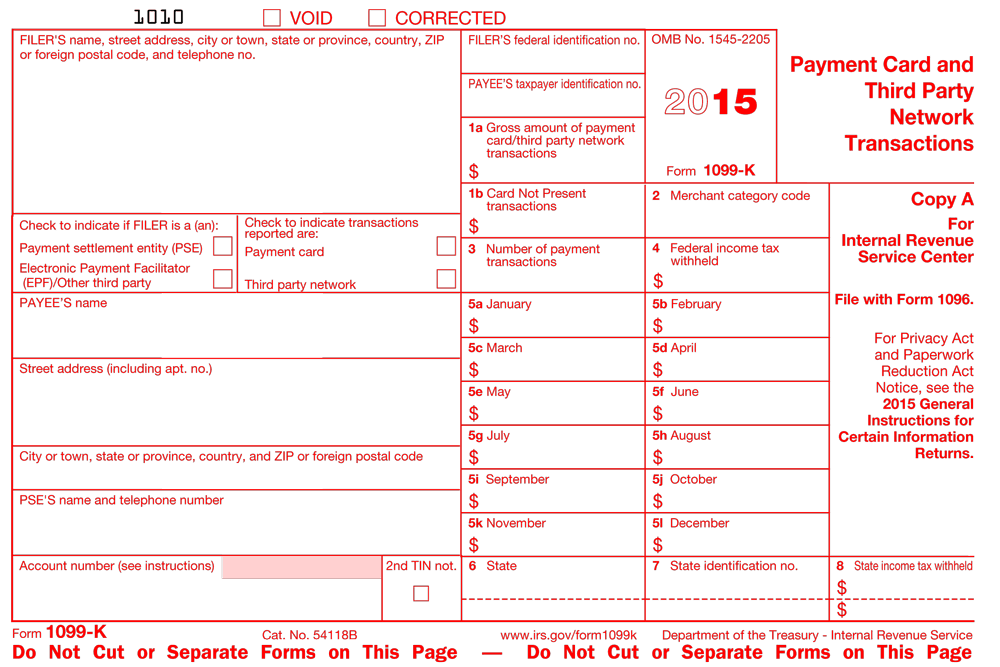

Form 1099-K - IRS Tax Changes and Business Accounts

Solved: Received 1099-K from Reverb and PayPal, but sold only personal items at a loss. This link suggests no need to report: - thoughts?

IRS delays $600 1099-K reporting for another year : r/personalfinance

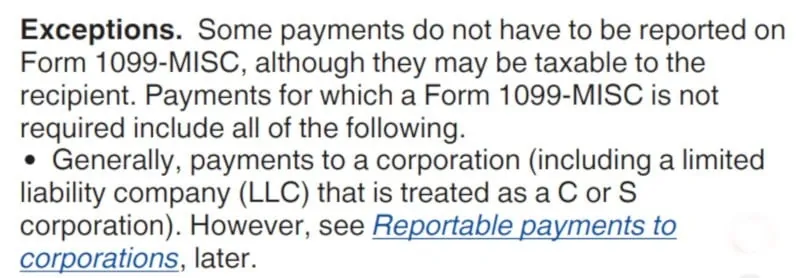

1099-NEC: When You Should & Shouldn't Be Filing - Eric Nisall

1099-NEC: When You Should & Shouldn't Be Filing - Eric Nisall

or Sale of $600 Now Prompt an IRS Form 1099-K

Gibson CPA, LLC

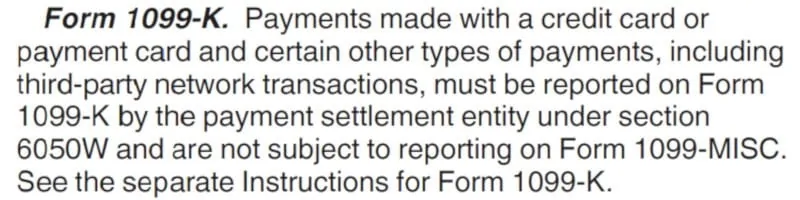

Jobber Payments and 1099-K – Jobber Help Center

Here's why you may need to file a 1099-K form this tax season

:max_bytes(150000):strip_icc()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

1099-MISC Form: What It Is and What It's Used For

What is a 1099-K, How Does It Affect My Business? - VMS

Tax News Archives - Optima Tax Relief

Recomendado para você

-

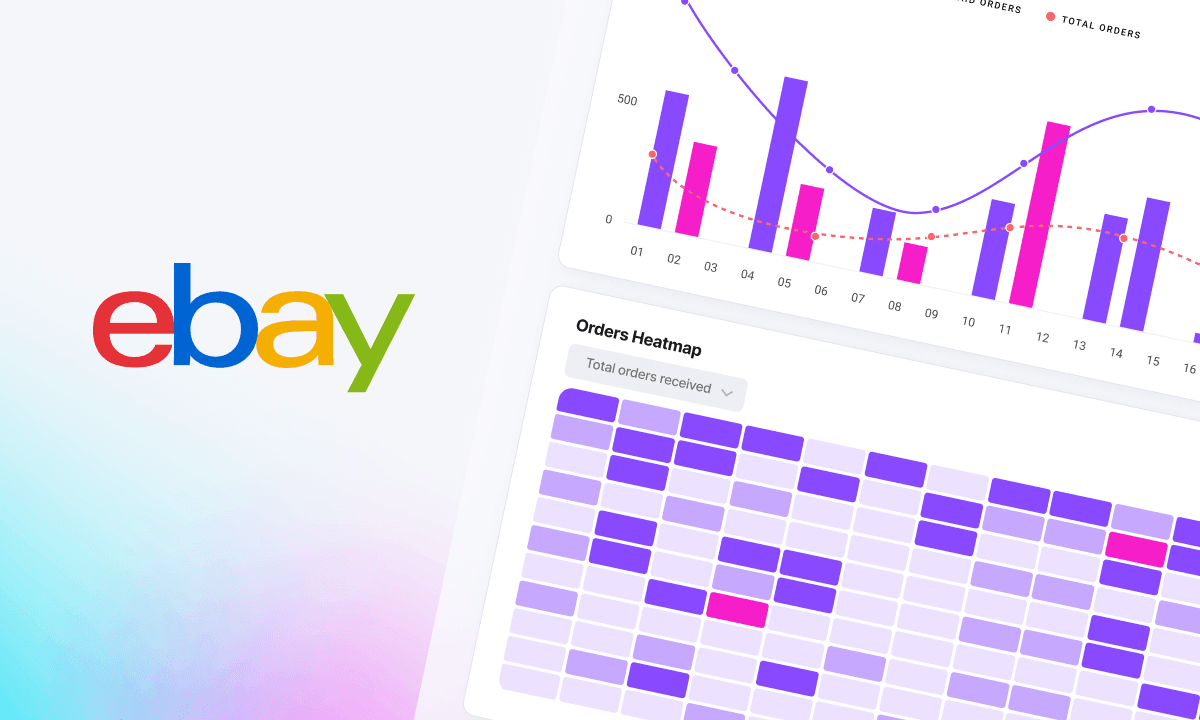

Electronics, Cars, Fashion, Collectibles & More02 abril 2025

Electronics, Cars, Fashion, Collectibles & More02 abril 2025 -

statistics 202202 abril 2025

statistics 202202 abril 2025 -

is launching an interactive live shopping platform02 abril 2025

is launching an interactive live shopping platform02 abril 2025 -

Dropshipping Tool - Software02 abril 2025

Dropshipping Tool - Software02 abril 2025 -

U.S. sues over sale of harmful products02 abril 2025

U.S. sues over sale of harmful products02 abril 2025 -

How Created a Global Community of Doing Good02 abril 2025

How Created a Global Community of Doing Good02 abril 2025 -

Optimised Product Listing and Cataloging02 abril 2025

Optimised Product Listing and Cataloging02 abril 2025 -

What to sell on in 2023, Best Sellers02 abril 2025

What to sell on in 2023, Best Sellers02 abril 2025 -

Subscriber discounts02 abril 2025

Subscriber discounts02 abril 2025 -

Helping start a conversation with the world - DEPT®02 abril 2025

Helping start a conversation with the world - DEPT®02 abril 2025

você pode gostar

-

Moto Moto meets Gloria02 abril 2025

Moto Moto meets Gloria02 abril 2025 -

Cybertown Subterranean Normal : Download For Free, View Sample Text, Rating And More On02 abril 2025

Cybertown Subterranean Normal : Download For Free, View Sample Text, Rating And More On02 abril 2025 -

![Pokemon Sword - Shiny Gigantamax Gengar [Nintendo Switch]](https://i.ytimg.com/vi/ucmiV9nMGRs/maxresdefault.jpg) Pokemon Sword - Shiny Gigantamax Gengar [Nintendo Switch]02 abril 2025

Pokemon Sword - Shiny Gigantamax Gengar [Nintendo Switch]02 abril 2025 -

Guess which 2 people complained that Vi was too tanky : r/ARAM02 abril 2025

Guess which 2 people complained that Vi was too tanky : r/ARAM02 abril 2025 -

Alphabet Lore Plush Toys,Alphabet Lore Stuffed Animal Plush Doll,Alphabet Lore Plushies Toys for Fans Birthday Thanksgiving Christmas02 abril 2025

Alphabet Lore Plush Toys,Alphabet Lore Stuffed Animal Plush Doll,Alphabet Lore Plushies Toys for Fans Birthday Thanksgiving Christmas02 abril 2025 -

🎮 Onde encontrar Meaty Tails em Tower of Fantasy02 abril 2025

🎮 Onde encontrar Meaty Tails em Tower of Fantasy02 abril 2025 -

Mod Choo Choo Charles for MCPE for Android - Free App Download02 abril 2025

-

Reembolso! - Comunidade Google Play02 abril 2025

Reembolso! - Comunidade Google Play02 abril 2025 -

Ken and Ryu Pack02 abril 2025

Ken and Ryu Pack02 abril 2025 -

COD Mobile Season 1 (2023): Release Date, Time & Battle Pass02 abril 2025

COD Mobile Season 1 (2023): Release Date, Time & Battle Pass02 abril 2025