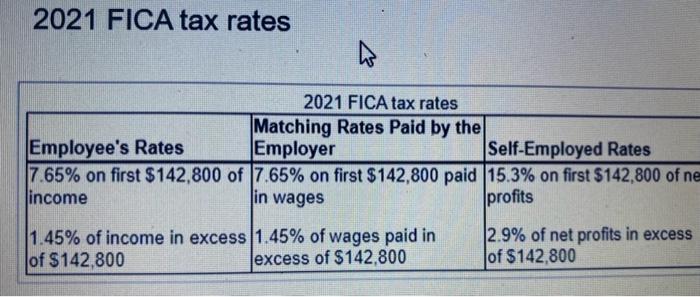

2021 FICA Tax Rates

Por um escritor misterioso

Last updated 31 janeiro 2025

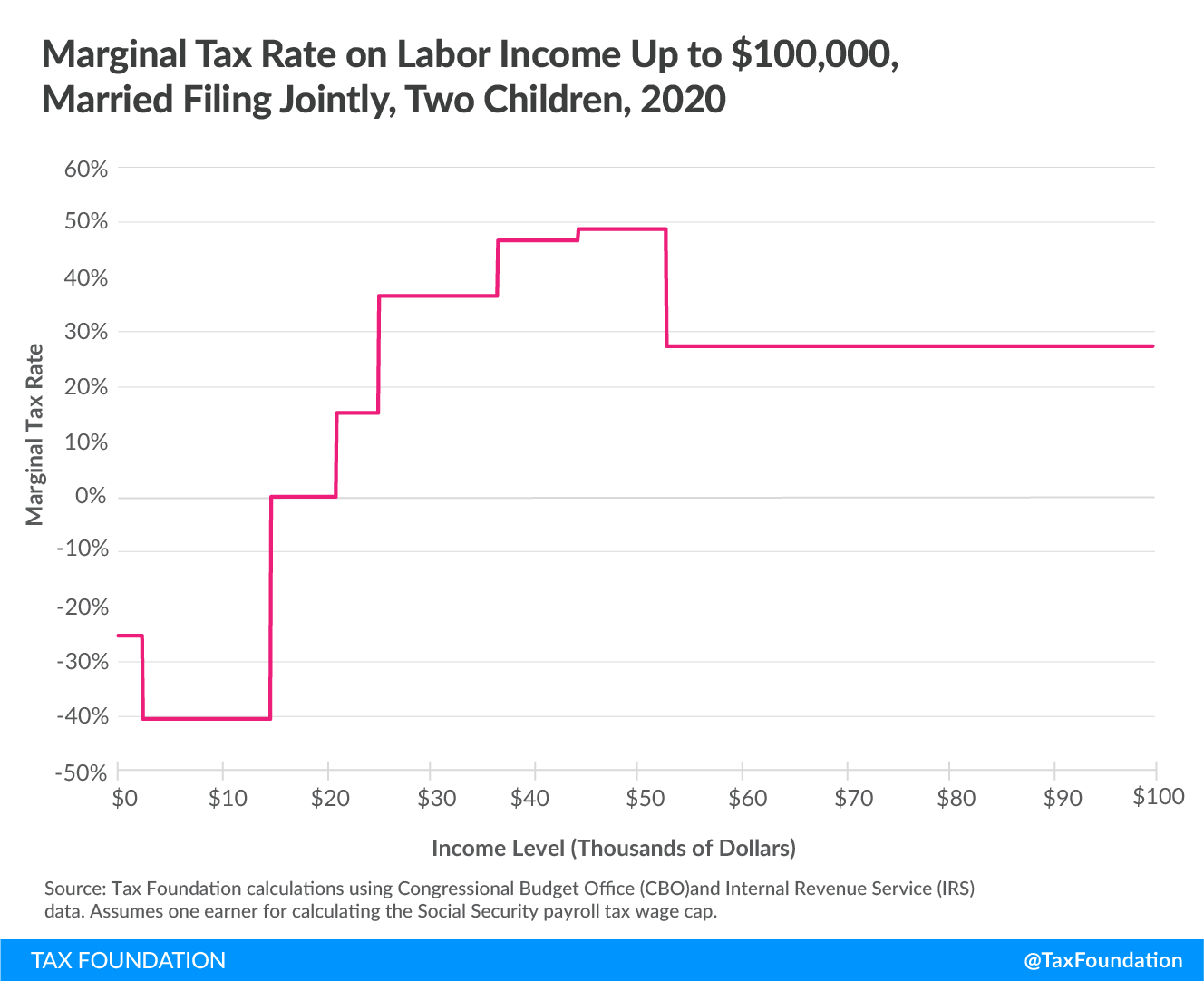

Social Security and Medicare income limits and tax rates FICA tax is a combination of a Social Security tax and a Medicare tax. The Social Security tax is assessed on wages up to $142,800 ($137,700 in 2020); the Medicare tax is assessed on all wages.

Do You Have To Pay Tax On Your Social Security Benefits?

What is the FICA Tax? - 2023 - Robinhood

Marginal Tax Rate Definition, TaxEDU

FICA Tax: What It is and How to Calculate It

Federal Tax Income Brackets For 2023 And 2024

Taxes – Payroll taxes, especially Social Security, are regressive … NOT !!!

Uncapping the Social Security Tax – People's Policy Project

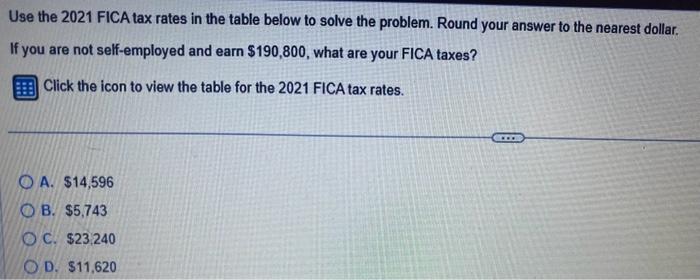

Solved Use the 2021 FICA tax rates in the table below to

Medicare Tax: Current Rate, Who Pays & Why It's Mandatory

Solved Use the 2021 FICA tax rates in the table below to

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations

Recomendado para você

-

What Is FICA Tax? A Complete Guide for Small Businesses31 janeiro 2025

What Is FICA Tax? A Complete Guide for Small Businesses31 janeiro 2025 -

What is FICA31 janeiro 2025

What is FICA31 janeiro 2025 -

FICA Tax Exemption for Nonresident Aliens Explained31 janeiro 2025

FICA Tax Exemption for Nonresident Aliens Explained31 janeiro 2025 -

Requesting FICA Tax Refunds For W2 Employees With Multiple Employers31 janeiro 2025

Requesting FICA Tax Refunds For W2 Employees With Multiple Employers31 janeiro 2025 -

What is the FICA Tax and How Does it Connect to Social Security?31 janeiro 2025

-

FICA Refund: How to claim it on your 1040 Tax Return?31 janeiro 2025

FICA Refund: How to claim it on your 1040 Tax Return?31 janeiro 2025 -

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet31 janeiro 2025

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet31 janeiro 2025 -

What is the FICA Tax? - 2023 - Robinhood31 janeiro 2025

-

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software31 janeiro 2025

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software31 janeiro 2025 -

FICA Tax in 2022-2023: What Small Businesses Need to Know31 janeiro 2025

FICA Tax in 2022-2023: What Small Businesses Need to Know31 janeiro 2025

você pode gostar

-

A história principal de Fontaine chega em seu clímax com a Versão 4.2 de Genshin Impact, a partir de 8 de novembro31 janeiro 2025

A história principal de Fontaine chega em seu clímax com a Versão 4.2 de Genshin Impact, a partir de 8 de novembro31 janeiro 2025 -

/cdn.vox-cdn.com/uploads/chorus_asset/file/23592281/fhm1031_106_comp_wta_v0106_76d40e3c.jpeg) Marvel's Moon Knight brings Egypt's controversial mahraganat rap31 janeiro 2025

Marvel's Moon Knight brings Egypt's controversial mahraganat rap31 janeiro 2025 -

Pl401 Revista Psw World Nº43 Spider Man 3 Detonado31 janeiro 2025

Pl401 Revista Psw World Nº43 Spider Man 3 Detonado31 janeiro 2025 -

Ludo Supreme™ Online Gold Star - Apps on Google Play31 janeiro 2025

-

Rurouni Kenshin: Meiji Kenkaku Romantan (2023) Dublado - Episódio31 janeiro 2025

Rurouni Kenshin: Meiji Kenkaku Romantan (2023) Dublado - Episódio31 janeiro 2025 -

Anime Review XVI: Digimon Adventure Tri – The Traditional Catholic Weeb31 janeiro 2025

Anime Review XVI: Digimon Adventure Tri – The Traditional Catholic Weeb31 janeiro 2025 -

Shema Israel Jewish Prayer Hebrew Wall Sticker Living Room Bedroom Holiday Decoration Outdoor & Indoor Sign Wall Decal - AliExpress31 janeiro 2025

Shema Israel Jewish Prayer Hebrew Wall Sticker Living Room Bedroom Holiday Decoration Outdoor & Indoor Sign Wall Decal - AliExpress31 janeiro 2025 -

blue lock ep 431 janeiro 2025

blue lock ep 431 janeiro 2025 -

SCP Logo Document REDACTED Poster for Sale by ToadKingStudios31 janeiro 2025

SCP Logo Document REDACTED Poster for Sale by ToadKingStudios31 janeiro 2025 -

Comprar Pacote de Carros Conversíveis do Forza Horizon 4 (PC / Xbox ONE / Xbox Series X31 janeiro 2025

Comprar Pacote de Carros Conversíveis do Forza Horizon 4 (PC / Xbox ONE / Xbox Series X31 janeiro 2025